The spiral of rising contributions increases the cost per hour worked by 5.4%.

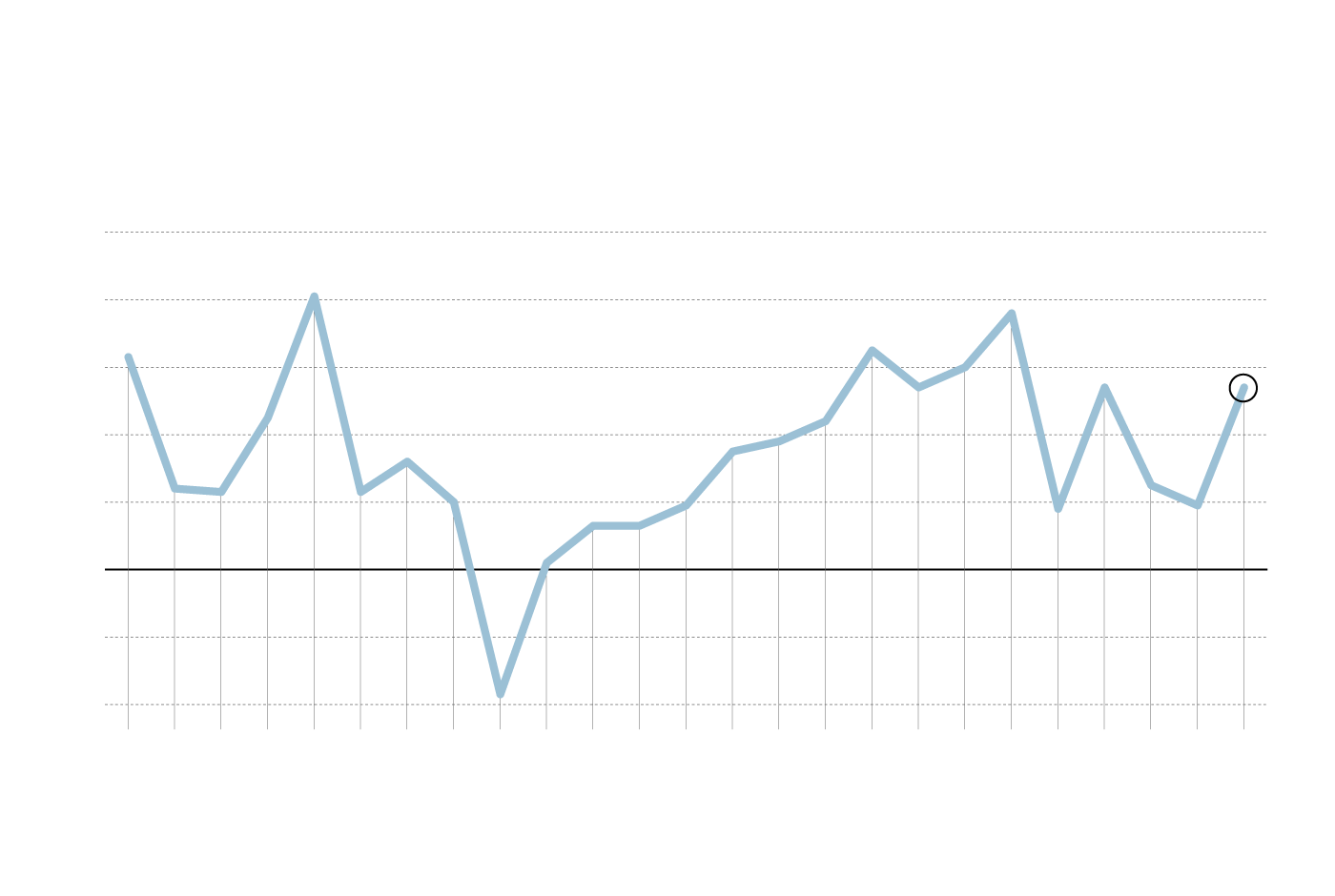

Costs per hour worked, which include salaries, contributions, bonus payments, arrears, and other expenses , continue to rise, driven by years of rising social security contributions to pay pensions and by the recovery of salaries, which are growing by more than 4% under collective bargaining agreements. Data from the Harmonized Labor Cost Index reflect a new surge, which has boosted the cost per hour worked by 5.4% in the second quarter compared to the same period last year, a rate 3.5 points higher than the previous quarter and the highest since the third quarter of 2024, according to data from the INE (National Institute of Statistics and Census). With the increase, labor costs mark 16 consecutive quarters of year-on-year increases.

The activities that recorded the largest year-on-year increases in hourly wage costs in the second quarter of 2025 were other services (+8.1%) , professional, scientific, and technical activities (+8%), and the extractive industries (+7.9%). The most moderate increases were recorded in artistic and recreational activities (+2.1%), public administration (+2.2%), and financial and insurance activities (+2.8%).

The evolution of labor costs reflects the impact of the spiral of rising social security contributions, as well as the recovery of wages agreed upon in collective bargaining agreements. The pressure on the pockets of companies and workers since Pedro Sánchez took office is unprecedented. 2025 has broken all records , a year in which the highest-paid workers who contribute to Social Security already bear the brunt of the extra payments designed by former minister José Luis Escrivá, especially companies, which bear the brunt of the disbursements. New blows to the productive fabric, and penalties for the most highly qualified jobs, which command the highest salaries.

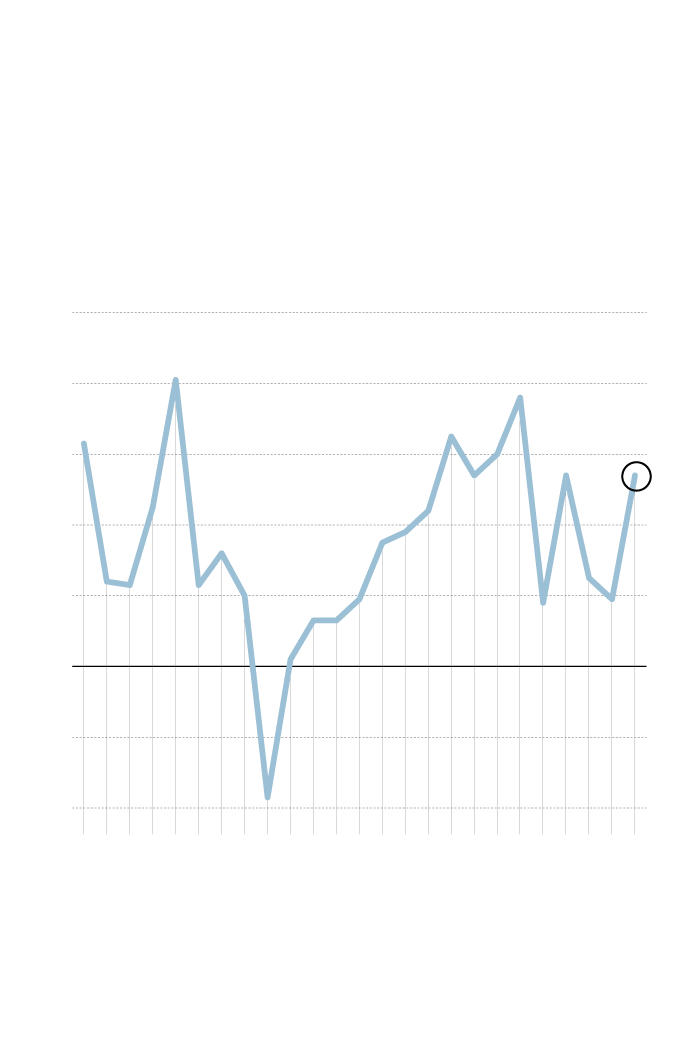

Cost index

harmonized labor

General index. Base 2020

Annual rate of change. In percentage

Harmonized labor cost index

General index. Base 2020

Annual rate of change. In percentage

In 2025, the maximum contribution base has increased by 2.8%, the average year-on-year change in the CPI between December 2023 and November 2024. This percentage will be increased by an additional 1.2% due to the uncapping of the contribution base , which began this year and will remain in place until 2050, when the cumulative increases will reach 38%. Both increases are compounded by another 0.8% from the Intergenerational Equity Mechanism (MEI ), which applies to all payrolls regardless of salary level, and the "solidarity quota," which will be borne by salaries over €59,000. This "quota" will not generate retirement rights, so it is a tax.

Adding to this collection of surcharges would be the impact of reducing working hours to 37.5% without pay cuts, if it were to be approved. Business owners are holding their breath to prevent it from passing in Congress due to the new burdens it would impose, especially on SMEs and the self-employed at a particularly delicate time for their viability. The CEOE estimates that this reduction in the working week would cost more than 23 billion euros and has warned that if it were to be approved, it would also lead to higher prices.

The reduction in working hours faces a key vote in the Congress of Deputies on Wednesday, with the debate on the amendments presented by the PP, Vox, and Junts calling for the bill to be returned to the government. The combined vote of the three parties constitutes a sufficient majority to shelve Yolanda Díaz's flagship project, which would translate into the biggest political defeat since she became second vice president .

The expected setback in the lower house does not discourage Díaz, who has already warned that if the law is overturned, she will approve a decree to strengthen the daily record of working hours. This option would eliminate the possibility of negotiating the measure, one of the most worrying aspects for employers. The Minister of Labor and her team have designed a registry, monitored in real time by the Labor Inspectorate, which will have remote access to this tool, designed to accompany the implementation of the reduction in working hours. Failure to do so will result in very high fines, up to €10,000 per worker , a decision that radically changes the sanctions currently applied, which are per company and do not reach €7,500.

Companies are navigating this uncertain environment, facing a horizon fraught with uncertainty, bureaucracy, and severe financial penalties for noncompliance. This is an explosive cocktail for many businesses, especially smaller ones, which have far fewer opportunities to adapt to change.

ABC.es