Deutsche Perle delivers – Interview with the board

FRoSTA shares are surging: While many food manufacturers are suffering from price pressure, the frozen food specialist is scoring points with its clear profile, pricing power, and low-CO₂ products. Why the board is focusing on AI, keeping an eye on flexitarians, and why the share price is now poised to reach a new high – read this exclusive interview.

In issue 18/25 of DER AKTIONÄR, FRoSTA was featured as a community share – with a compelling investment case. Operating cash flow climbed to over €90 million in 2024, and the EBITDA margin reached 12.3 percent. The equity ratio is a solid 50 percent.

Despite price increases, growing competition in the organic and discount segments, and declining private label brands, FRoSTA is successfully defending its premium position. The stock has recently shown strength, trading only 10.5 percent below its all-time high.

What the strategy supports and what investors need to know now – in an interview: FRoSTA CFO Maik Busse in conversation with DER AKTIONÄR.

THE SHAREHOLDER: The FRoSTA Purity Law is your clear USP. Given rising raw material and energy costs, how do you manage to maintain uncompromising product quality while simultaneously securing margins?

Maik Busse: Fundamentally, it's important to create a consumer understanding that "real food" without any additives can come at a price, but also taste better. At the same time, we work with all partners in the value chain to improve our quality and our ecological footprint, and to achieve cost savings through synergies and process improvements.

Demand for honest products remains high. However, discounters are expanding their organic and purity offerings. How do you defend your profile as a premium provider in an increasingly saturated market?

Trust is based on transparency and honesty. In the past, we have demonstrated with many initiatives that we challenge our industry in this regard. Examples include our Purity Law, measuring our carbon footprint, transparent ingredient information on our packaging, and the continued use of new, more environmentally friendly packaging and production concepts. We will continue to shape our company and the FRoSTA brand in this spirit in the future.

You've set your focus on Europe. Do you plan to enter new export markets?

We're closely monitoring all markets. It's important not to lose focus.

Vegan frozen food is booming. What specific share of sales are you aiming for from plant-based products by 2027?

Purely vegan products are still a niche in most markets.

If you include vegetarian and vegetable products, that already accounts for over 20 percent of our portfolio. Our consumers are often "flexitarians." Ultimately, it's the consumer who decides. At FRoSTA, we offer a healthy mix.

Digitalization and automation are transforming production. Where does FRoSTA stand today in terms of smart factories and the use of artificial intelligence?

We're on the right track. In recent years, we've invested heavily in our systems and data infrastructure, laying important foundations. Examples include the implementation of SAP S/4 back in 2019 and our relatively early decision in 2021 to fully embrace the cloud. Since then, we've continued to work on connecting with our partners in the value chain and improving our data structures, thus laying the foundation for the effective use of AI, particularly to further improve the quality and cost structures of FRoSTA products.

FRoSTA shares significantly outperformed the SDAX in 2024. What are you doing differently than many medium-sized food companies?

We make food as it should be and focus entirely on the consumer.

Do you plan to increase your dividend in 2025, or are you prioritizing reinvestment in growth and innovation?

Our solid earnings performance and balance sheet structure give us the independence to make necessary future decisions. We pursue a stable dividend policy, which we aim to steadily increase with sustained good results, while simultaneously investing in the future.

Why should investors invest in FRoSTA shares right now?

We believe in the relevance of our FRoSTA brand, which complies with the German Purity Law, and strive to continually improve the production of fresh frozen foods. In the recent global challenges of the coronavirus, the energy crisis, and inflation, the FRoSTA brand has proven that it can make a positive difference. Ultimately, the decision lies with investors—just as it does with our consumers.

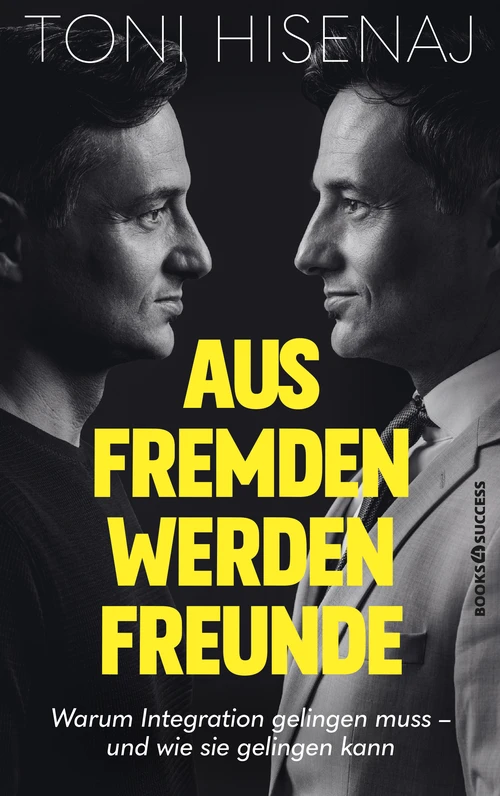

Our economy, our healthcare system, and our social welfare system depend on immigration. However, in the shadow of the migration debate, the necessary welcoming culture for these people is unfortunately far too often overlooked – often resulting in the loss of valuable skilled workers. Toni Hisenaj – himself an immigrant – draws on autobiographical experiences for this book. He sheds light on both the sometimes absurd bureaucratic hurdles immigrants must overcome upon arriving in Germany and how things can be improved. And Hisenaj shows: Integration is not just a moral obligation – it is crucial for our economic and social progress!

deraktionaer.de