Revolut Review: Highlighting Its Top Benefits

The content on this page includes affiliate links. While clicking on these links won't cost you anything extra, we may earn a modest commission from any purchases.

Revolut is an all-in-one solution integrating bank accounts, investment tools, and payment cards into a single app. It also offers a wide range of additional features. In other words, it functions as a mobile bank. In this article, we explore its main features and subscription plans. Read on to discover what makes Revolut stand out.

Revolut in a NutshellRevolut is a company founded in the UK in 2015 by Nikolay Storonsky and Vlad Yatsenko. It holds a banking licence issued by Lithuania, allowing it to provide banking services in certain EU countries. In the UK, Revolut only applied for a banking licence in 2021. The bank has thousands of employees and has become profitable.

Revolut’s main product is a debit payment card with various additional services. Revolut lets users deposit money in different currencies, send funds easily to other Revolut users, and execute investment transactions. Revolut is a modern and versatile mobile bank with no physical branches.

Is Revolut Like Wise?Revolut and Wise share many features, but their focus areas differ. Revolut is a comprehensive mobile bank, whereas Wise primarily specialises in money transfers and currency exchange. However, the differences between the services have narrowed, as Wise has increasingly adopted mobile banking features, while Revolut has introduced functionalities similar to Wise. Wise and Revolut complement each other well, and both have a clear position in the market.

Revolut’s FeaturesRevolut is more than just a payment card; it offers banking services. The extensive range of services covers various banking needs. The features and pricing of these services depend on the user’s Revolut subscription level.

Bank AccountRevolut provides users with a euro-denominated bank account and an IBAN for standard bank transfers. Receiving and sending euro transfers within the SEPA area is free of charge. The SEPA (Single Euro Payments Area) region consists of 36 European countries where euro payments operate under uniform conditions.

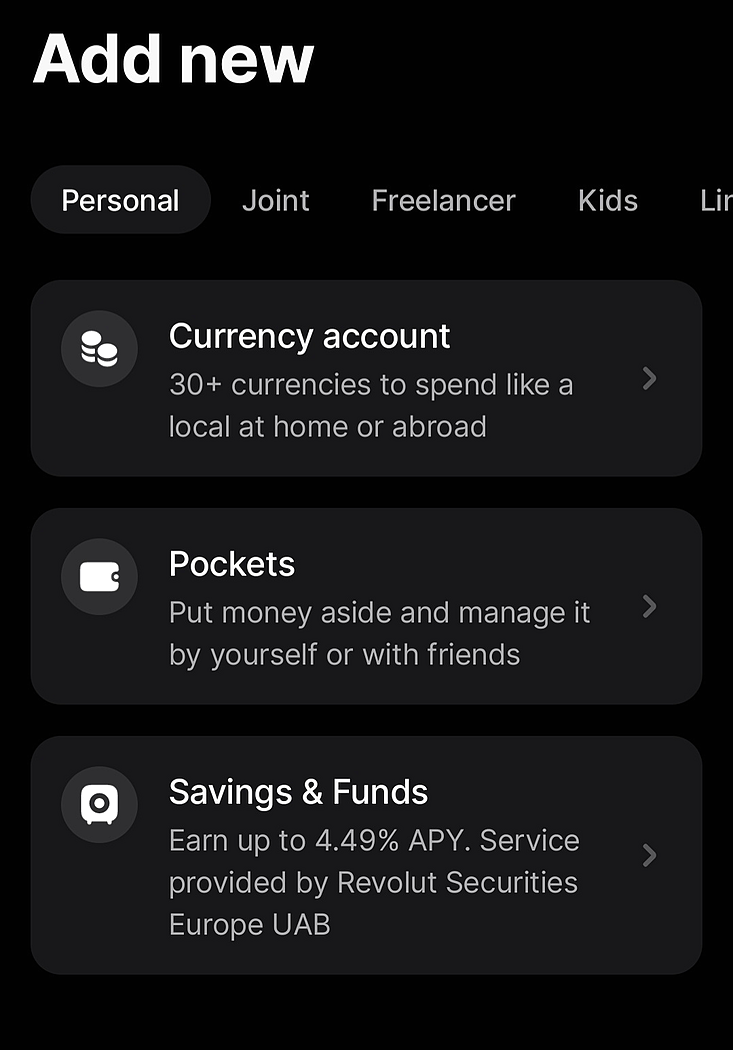

Multi-Currency AccountsYou can link individual payment cards to specific accounts within Revolut. For example, you can dedicate one card to your USD account and another to your EUR account. Alternatively, a card can access all your accounts, with Revolut automatically managing currency conversions when needed.

Revolut’s paid subscription tiers include various insurance policies. These include product insurance, fraud protection, travel, rental car, and trip cancellation insurance. We provide more details about these insurance options in the section covering Revolut’s subscription levels.

Payment CardsRevolut accounts can have physical payment cards. These cards do not have a monthly fee, but issuing and delivering a physical card may incur a charge. If virtual cards are sufficient, they can be created in the app free of charge. Virtual cards work well, for example, with Curve Pay, making a physical card unnecessary in many cases. Revolut also offers single-use card numbers, valid for payments on high-risk online marketplaces.

The number of free Revolut cards depends on the subscription level, and there is also an absolute limit on the number of cards regardless of the tier.

You can link a specific payment card to a particular Revolut account - for example, using one card for your USD account and another for your EUR account. Alternatively, you can configure a card to access all accounts, with Revolut automatically handling currency conversions when necessary.

Joint AccountsRevolut allows users to open a joint account with a partner, friend, or other individual. The funds in the account are shared, and both account holders can manage them through the mobile app. A separate payment card can also be ordered or created for the joint account.

An adult Revolut user can create linked profiles called Revolut <18 accounts, for one or more children. The adult can monitor the child’s account details via their app, while the child can install the app on their phone and receive a card for spending. The maximum number of linked <18 accounts depends on the adult’s Revolut subscription level.

A parent manages Revolut <18 accounts and is responsible for their use.

Revolut ProRevolut Pro is an additional feature within Revolut designed for freelancers, self-employed individuals, and small business owners. It provides a free business account option, including a separate IBAN, a physical card, and a virtual card. Revolut Pro does not incur an extra cost beyond the standard Revolut monthly fee, but receiving customer payments involves charges. Revolut Pro users can accept payments via card transactions and QR codes, helping to keep business expenses separate from personal Revolut spending. Users can earn up to 1% cashback on all card purchases, making Revolut Pro beneficial for active users.

Revolut Pro differs from Revolut Business as it is intended for sole traders and does not require business registration. The service is available through the Revolut app and helps manage income, expenses, and transactions efficiently.

Flexible Cash FundsFunds in Revolut accounts can generate returns when invested in Revolut’s interest-bearing funds. Using the funds involves a small investment risk. Interest rates vary between 2% and 5%, depending on the currency and the user's Revolut subscription level. Users can transfer funds back to their standard Revolut account anytime, making these funds a convenient and liquid investment option.

Stocks, Commodities, and CryptocurrenciesRevolut users can trade stocks, ETFs, commodities, and cryptocurrencies. Users must complete a questionnaire before making their first investment to confirm their understanding of investment risks. The service fees for trading are competitive compared to traditional banks.

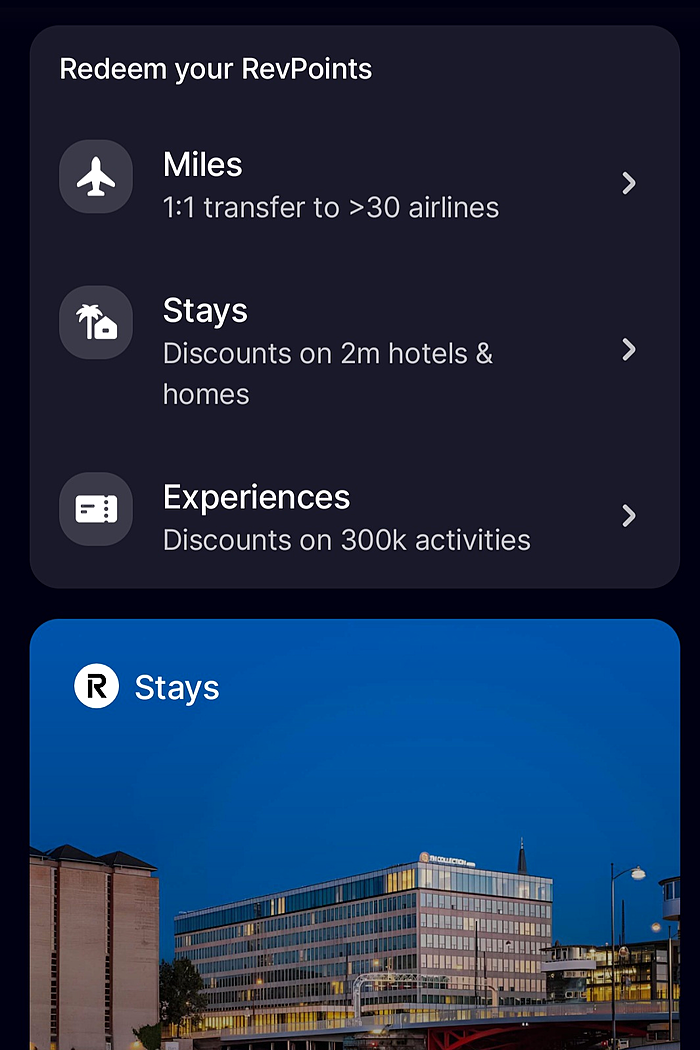

RevPointsRevPoints is Revolut’s rewards programme. Users earn points from purchases made with a Revolut card, which you can redeem for rewards. RevPoints can be transferred to airline loyalty programmes or used to book hotels. The rate at which points accumulate depends on the subscription level, with lower-tier plans accumulating points more slowly.

Besides banking services, Revolut offers other services such as airport lounge access and eSIM cards. Prices vary depending on the subscription level; in some cases, they may be free.

SmartDelay is a handy feature for travellers. Users can gain free access to airport lounges if a flight is delayed by over an hour. It is essential to check the terms and conditions to make full use of this benefit.

Revolut offers a wide range of services, so it is worth taking the time to understand its features properly. We have compiled a summary of Revolut’s subscription plans, but we recommend checking the details on Revolut’s official website, as plan features and prices may change frequently.

There are five subscription levels at the time of writing. Generally, higher-tier plans offer additional features compared to the previous tier.

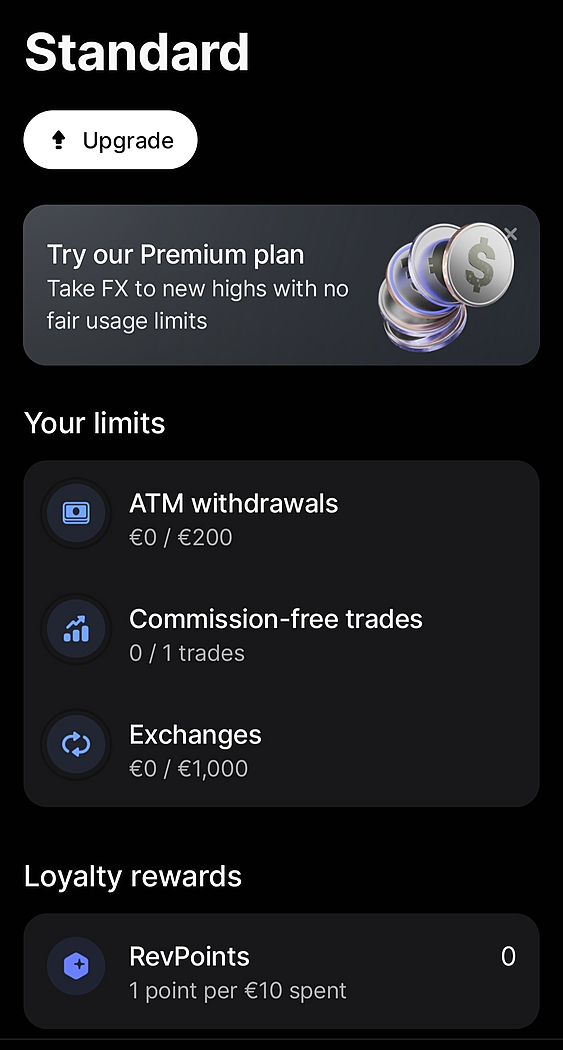

Revolut StandardRevolut Standard is a subscription with no monthly fee. It includes one physical Visa or Mastercard debit card, virtual cards, and an IBAN account number. Virtual cards are available for immediate use, while physical cards take a few weeks to arrive. Revolut charges a delivery fee for the physical card, but virtual cards are free.

A euro-denominated Revolut account has an international IBAN, allowing free bank transfers within the SEPA payment area. Currency conversions on weekdays are also free up to €1,000 per month, after which a 1% conversion fee applies. No interest is paid on account balances, making Revolut unsuitable as a savings account. However, you can invest funds in Revolut’s Flexible Cash Funds, which offer a small return in exchange for risk. Users can redeem their investments in their Revolut account.

The Standard plan supports one linked account for a child. Users needing more than one child account must upgrade to a paid subscription.

Regardless of the subscription level, Revolut allows trading in stocks, ETFs, funds, commodities, and cryptocurrencies. Standard-tier users get one commission-free trade per month.

Standard cardholders earn one RevPoint for every €10 spent. The accumulation of points is slow.

Standard members can access airport lounges for a one-time fee of €34 through the Chinese provider DragonPass. Users can also purchase eSIMs via the app.

The Standard subscription is suitable for occasional travellers. Currency conversions are free up to €1,000 per month for purchases and ATM withdrawals, but only the first €200 in ATM withdrawals is fee-free. After this, a 2% withdrawal fee applies. RevPoints accumulate slowly, making their benefits limited at the Standard level.

Revolut Plus is a slightly improved paid option over the Standard plan. It costs €3.99 per month, which is very reasonable.

Revolut Plus includes additional features over the Standard plan. It offers two physical cards, allows free currency conversions up to €3,000 per month, and increases the fee-free ATM withdrawal limit to €400. Plus-tier accounts also come with purchase protection insurance. RevPoints accumulate faster than on the Standard plan, and you can link up to two accounts for children that can instead of one.

Revolut Plus suits users who find the Standard plan sufficient but want extra insurance benefits and slightly better fund returns. It is also ideal for those needing multiple linked accounts for children.

Revolut PremiumRevolut Premium costs €9.99 per month. In return for the higher fee, it includes a range of additional services. Users also have more choices for card design, making it easier to get a visually appealing card.

The Premium plan raises the fee-free ATM withdrawal limit to €400 and removes the cap on free currency conversions, allowing unlimited transactions. It includes travel insurance in addition to all Plus-level insurance.

Premium users get seven free subscriptions to well-known services, including NordVPN, Tinder, and Wolt. NordVPN, in particular, is useful for travellers.

Revolut Premium is best suited for frequent travellers, including travel insurance and other protections. Additionally, if a flight is delayed by more than an hour, the cardholder and a companion can access an airport lounge for free. Other lounge visits cost €24, a competitive price.

Revolut Metal is the top-tier plan featuring a metal payment card. It costs €15.99 per month, making it a more premium option.

Besides the previously mentioned insurance benefits, Metal includes excess rental car insurance. ATM withdrawals are free up to €800. Our calculations show subscribers get free access to Revolut’s partner services—12. These include Financial Times and WeWork, among others.

Revolut Metal is ideal for stylish, frequent travellers who want the best insurance coverage and a premium-looking card. < strong>Revolut Metal is a good choice for users who value additional services more than low costs.

Revolut UltraRevolut Ultra is the highest and most expensive subscription tier, costing €60 per month.

The card includes a range of valuable perks. Users get unlimited free access to airport lounges. Fee-free ATM withdrawals go up to €2,000 per month. You get a free global eSIM with 3GB of data monthly. Significant discounts apply to international transfers.

Ultra also has an interesting cancellation insurance policy that allows users to cancel trips for any reason and get a refund of 70% of their costs. This insurance has complex terms, so we recommend reviewing the policy terms carefully.

Revolut Ultra is best for frequent travellers due to its unlimited lounge access and free eSIM benefits. The extensive cancellation insurance makes it easier to book low-cost flights. However, we do not recommend Revolut Ultra as a traveller’s primary card, as American Express Platinum offers even better benefits for a similar price.

Google and Apple Pay SupportAll Revolut cards are compatible with Google and Apple Pay. Merchants receive only a virtual card number provided by Google or Apple, making transactions more secure. Payments are also convenient, as a phone alone is sufficient for transactions.

Curve Pay is a viable alternative to Google and Apple Pay. It is a more versatile mobile wallet, and its basic tier is free.

Our Experiences with RevolutWe joined Revolut’s Standard plan to gain hands-on experience. We have not yet upgraded to a paid plan, as we are first exploring the app’s benefits without any costs. However, we see great potential in Revolut and will likely become paying users in the future.

Revolut AppWe installed the Revolut app on our phones. The installation and identity verification process went smoothly. Users must submit photos of their ID and a short video for verification. Once you have completed these steps, the app is ready to use.

Revolut accounts are managed entirely through its mobile app, just like other digital banking services. Essentially, Revolut functions as a mobile bank, where everything—from opening an account to daily banking tasks—is handled via the app. It offers a clear view of your balances, transaction history, and valuable spending statistics. You can also manage your cards directly in the app, including locking them or changing the PIN.

Our experience with the Revolut app has been positive. However, due to its extensive features, it initially felt slightly overwhelming. We became familiar with it quickly.

Getting a CardWe ordered a physical card via the app and created virtual cards. After we linked to Curve Pay, virtual cards worked immediately. The physical card arrived in the mail within days.

We deposited funds into our Revolut account using Google Pay. The transactions were fast and free, with funds available instantly. As Curve Pay users, we were pleased to find that Revolut integrates with Curve Pay.

RatingBased on our experience and research, we give Revolut a solid 4-star rating as a mobile bank. The app runs smoothly and offers a wide range of features. Revolut has evolved into a mature banking solution, though the abundance of options may feel overwhelming for those with simpler needs.

We had heard about Revolut for years but only recently decided to try it. It exceeded our expectations, proving to be a well-polished mobile bank with extensive features. The paid plans are reasonably priced, making it easy for active users to get their money’s worth.

The biggest challenge for new users is the number of features. Revolut is not just a payment card but a complete banking package. While it mainly targets young travellers, it is suitable for many others. Before subscribing, it is wise to review the terms and service descriptions carefully.

We usually cancel payment cards we no longer need after testing, but that wasn’t the case with Revolut. It and Curve Pay have become a regular part of our daily routine.

Tags: payment card, review, Revolut Destination:

finnoytravel