A symbolic change. SMYK will remain off the stock exchange. Will the drone manufacturer enter?

- Warsaw Stock Exchange at its highest level since May 2008.

- Polish banks granted PLN 10.7 billion in housing loans.

- Beijing focuses on imports and investments, limiting the role of exports.

- Is there no place for SMYK on the Warsaw Stock Exchange?

We started the week with new plans from Beijing. China intends to change its economic growth model. The Middle Kingdom is expected to be more similar to the United States in this respect. Imports are to increase and foreign investment is to be opened up. These declarations, while favorable to negotiations with the US, have broader implications: they are intended to systematically strengthen the yuan in global circulation and build an alternative to the dollar and the US financial market. Is China ending its export dominance? You can read more about China's new strategy in Monday's analysis, " China Wants an Economy Like the United States [HIRSCH ON THE ECONOMY] ."

From China, let's move on to another American adversary – Russia. The Russian Central Bank is lowering interest rates despite persistently elevated inflation and rising inflation expectations (including after the VAT announcement). While the slowdown in the rate of cuts is intended to stabilize the ruble, the main motivation behind the decision is to combat GDP stagnation (forecasted at 0.5-1.0% per year) and sustain weakening economic growth. Those interested in this topic are encouraged to read the text in question.

On Monday, we also considered the conclusions of a new report by the Energy Regulatory Authority (PIE). It turns out that if we decide to build more gas-fired power plants, we could face a serious problem. This is due to record demand for gas turbines, which exceeds production capacity. Currently, these turbines amount to approximately 60 GW per year, with orders reaching 80 GW. This record demand stems from the renewable energy revolution, which requires supplementation from stable power plants. Therefore, the choice must fall on coal, nuclear, or gas. Manufacturers (GE, Siemens) are seeing stock gains, but they consider this boom to be temporary, which is hampering investment in production capacity.

The final topic under review was a statement from Millennium Bank's vice president. Fernando Bicho claims that whether banks will pass on the increased corporate income tax (CIT) costs to their customers is currently uncertain and will depend on the level of competition in the sector . The regulations passed in the Sejm (lower house of parliament) are expected to increase the CIT rate for banks from the current 19% to 30% in 2026. In 2027, the tax is expected to drop to 26%, and from 2028, it will remain at 23%.

Bull market everywhere but RussiaWe also started Tuesday with international news. Most stock markets around the world are experiencing a bull market, breaking all-time records . The United States, Brazil, Chile, Peru, Colombia, the United Kingdom, the Netherlands, Sweden, Spain, Romania, and Poland are all countries where stock markets have reached historic highs. The global exception, however, is Moscow, where the Moscow stock exchange index fell 2.6% on Monday, reaching its lowest level since December of last year. Read about the reasons for this in Tuesday's summary, " Bull Market Everywhere But Russia [HIRSCH ON THE ECONOMY] ."

Good economic news, in turn, is coming from Poland's western neighbor. German entrepreneurs' expectations for the future are currently the most optimistic since 2022. However, we have an interesting situation here. While the assessment of the current situation is currently tragically low, expectations look very positive. Are we seeing the long-awaited recovery in German industry?

Let's move on to Poland, where the General Directorate for National Roads and Motorways (GDDKiA) has announced that it will open over 250 km of new roads this year , including a section of the A2 motorway from Siedlce to Biała Podlaska, a section of the S6 from the Koszalin bypass to Słupsk, a section of the S7 connecting Żukowo with the Gdańsk southern bypass, and a section of the S19 Haćki-Boćki route between Białystok and Siemiatycze, bypassing Bielsk Podlaski. This brings the total to over 400 km of new roads completed this year. Those interested in new tenders and GDDKiA plans should read Tuesday's summary.

Since the beginning of November, interest rates on retail bonds have been reduced. The most popular three-year bonds now offer 4.9%, while 10-year bonds offer 5.75% in the first year. This is the second reduction this year. The decreased attractiveness of treasury securities translates into a noticeable decline in their sales; through September, they amounted to PLN 58.2 billion, compared to PLN 67.2 billion a year ago.

New ECB data indicate an acceleration in lending in the eurozone. Household loans rose by 2.6% year-on-year in September, the fastest pace since March 2023. Although corporate lending (2.9%) slowed slightly, the overall trend points to potential support for economic growth through a boost in consumption and investment. However, this growth is historically low compared to pre-crisis years.

Investors have reasons to be satisfiedWe started Wednesday by discussing the record-breaking stock market performance. The WIG-20 index broke through 3,000 points on Tuesday, marking its highest level since May 2008. Although there was a slight correction in the following days, it remains close to 3,000 points. At the same time, the Polish stock market is among the strongest in the world this year. The stock market's performance is primarily driven by energy companies and banks. You can read more about the reasons for these significant gains in Wednesday's article , " Investor Profits Growing on the Warsaw Stock Exchange [HIRSCH ON THE ECONOMY] ."

In the US, however, society is reeling not from stock market records but from mass layoffs. Amazon announced it will lay off 14,000 corporate employees, or 4% of this group. The reductions, though unofficially linked to AI automation, are part of an announced restructuring. The company expects further cuts in 2026. At the same time, despite hundreds of billions of dollars of investment in AI by tech giants, many companies implementing these services still struggle to report real economic benefits and returns on these investments.

Speaking of tech giants and AI, it's hard not to mention NVIDIA's announcement that it will invest $1 billion in Finnish company Nokia, acquiring a 2.9% stake. Nokia, currently focused on telecommunications networking solutions, is expected to support Nvidia's plans to expand the infrastructure necessary for AI technology. This announcement sparked euphoria on the Helsinki Stock Exchange, sending Nokia's share price up 20.9% to its highest level since 2015. Despite this, the company remains a shadow of its early 21st-century self.

Let's stick with the topic of artificial intelligence and stock market giants, as Microsoft has reached a groundbreaking agreement with OpenAI, securing a 27% stake after the latter's transformation from a non-profit to a commercial company . This announcement resulted in a short-lived surge in the company's market capitalization, surpassing $4 trillion. Currently, only two publicly traded companies—NVIDIA and Apple—are worth over $4 trillion.

The Polish budget in a nutshell - record social spending and deficitWe started Thursday with news that social spending in Poland exceeded 22% of GDP in the second quarter of this year . This is a record. The fiscal deficit for the last 12 months has already reached 7% of GDP. Even in 2020, it wasn't this high. The deficit is growing because spending is rising while state revenues are stagnant. For those interested in the reasons for this situation, we encourage you to read the full summary : " Social spending in Poland is breaking records, it's already over 22% of GDP [HIRSCH ON THE ECONOMY] ."

Let's move on to the US, where the Fed, in line with market expectations, lowered interest rates to 3.75-4.00%. It's worth noting, however, that Chairman Powell took a cautious stance regarding further cuts. He cited the ambiguous economic data (labor market, inflation) caused by the partial government shutdown as the reason. The market immediately revised expectations: the probability of a December rate cut fell from 90 to 70 percent. The unclear prospect of rate cuts triggered stock market declines, although the Nasdaq remained positive thanks to a surge in Nvidia, which surpassed $5 trillion in valuation for the first time in history on Wednesday.

The Fed meeting wasn't the only important event in the American financial world. First, Microsoft, Alphabet, and Meta Platforms reported their quarterly results, followed by the long-awaited meeting between the presidents of the United States and China. Both the results and the meeting proved disappointing, weighing on the American stock market. You can read more about the companies' earnings and the meeting's outcomes in Thursday's summary.

Let's return to Poland, where banks reported a record value of newly granted mortgage loans in September, reaching PLN 10.7 billion, representing a 63% increase year-on-year . However, demand remains largely unmet, as the value of applications (PLN 18.9 billion) is nearly twice as high. The main reason for this high activity is the increasing creditworthiness of Poles, stimulated by NBP rate cuts (a total of 1.25 percentage points this year) and rising real incomes. The NBP is considering pausing further cuts.

Bank economists, specifically analysts at Pekao SA, forecast Poland's real GDP growth at 4% in 2026. This would be the best result until 2022, when the recovery from the 2020 pandemic recession was still underway. You can read about the details of the forecast for next year in the text discussed above.

Meta Platforms is racking up $30 billion in debt. Smyk's IPO fails, will the drone manufacturer go public?Friday began with news from the US. A day after a weak report, Meta Platforms raised $30 billion in debt – the largest corporate issuance in over two years and the fifth largest in history. The funds were earmarked for artificial intelligence development, which is intended to alleviate investor concerns about a cash crunch and a potential reduction in share buybacks. Demand for Meta's bonds reached $125 billion, signaling market confidence in its repayment capacity.

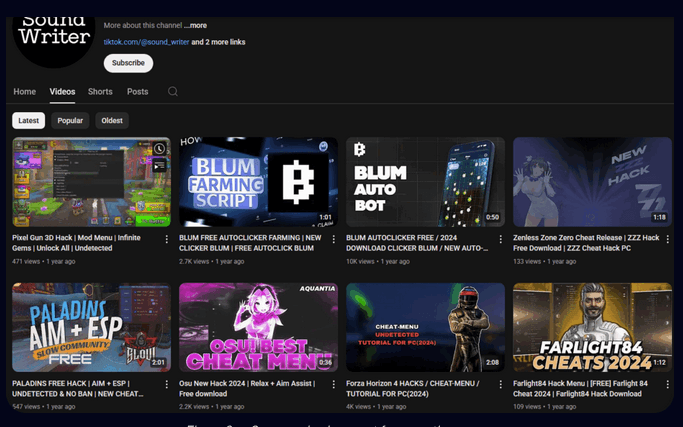

Interesting developments are also taking place on the Polish stock exchange. The Polish capital market noted the failure of Smyk's debut – the company withdrew its public offering due to insufficient demand. Investors were concerned about the company's prospects amid declining demographics, ignoring arguments about rising childcare costs and expansion. Instead of a children's goods store, another player may appear on the stock exchange – WB Electronics . You can read more about WB Electronics's possible debut in the article " The largest debt issue this year – Facebook and Instagram are behind it [HIRSCH ON THE ECONOMY] ."

According to Eurostat data for September, the unemployment rate in Poland remained at 3.2%, placing the country fourth in the EU . This rate, calculated using the International Labor Organization's methodology (active job search), is lower than the national Central Statistical Office (GUS) data. Among people under 25, unemployment rose to 13%, remaining below the EU average. Spain has the highest unemployment rate in the EU, although Sweden is not much better.

Eurostat's preliminary GDP growth data for the third quarter also looks interesting. They indicate better-than-expected GDP growth in the eurozone (0.2% q/q). The biggest surprise came from France (0.5% q/q growth), thanks to strong exports (especially aviation/space) and investment, despite weak consumption. Major economies – Germany and Italy – are stagnating (0.0% q/q), while Finland is in recession (-0.1% q/q). Poland will release its data (around 3.7% y/y) in mid-November.

The final topic discussed was an announcement by Deputy Minister of Funds Jan Szyszko. The politician announced that a record PLN 100 billion will be transferred to Poland from the Reconstruction Fund (KPO) in 2026. These final tranches are intended to fuel investment growth and contribute to faster GDP growth. A €6.2 billion (approximately PLN 26 billion) tranche, approved by the European Commission, is expected to be transferred this year (early December). The funds will be primarily allocated to the energy sector, including transmission grids and offshore wind farms, adding to the current total of approximately PLN 67 billion.

What awaits us in the coming week?On Monday, markets will focus on the release of manufacturing PMI indices in Europe and the US. Final readings from the major eurozone economies (Germany, France, Italy) and data from Central Europe (Poland, the Czech Republic, Hungary) will be released. Poland is expected to see a slight improvement to 48.6, though still below the 50 mark that separates expansion from contraction. The key release in late afternoon will be the ISM report for US manufacturing, covering sub-indices of prices, employment, and new orders.

Tuesday will bring important data from the US economy regarding durable goods orders and the full foreign trade report for September, which will indicate the dynamics of exports and imports. Investors will also be watching the quarterly reports of large international companies: Pfizer will release its third-quarter 2025 results before the NYSE session, and energy giant BP will present its report in London.

Wednesday will be a day of intense central bank decisions and the release of services indicators. The most important is the Monetary Policy Council's decision on interest rates in Poland, with the reference rate expected to remain at 4.50%. At the same time, a statement will arrive from Poland following the Monetary Policy Council meeting. In Sweden, the Riksbank is expected to maintain rates at 1.75%. Macroeconomic data will include the PMI for services in the eurozone, as well as German industrial orders, which are expected to rebound and grow by 1.1%.

On Thursday, markets will react to the release of financial results, including those of Polish banks PKOBP and PEKAO and the retail chain DINOPL. The Bank of England (BoE) will also attract attention with its interest rate decision (expected to remain at 4.00%) and the publication of its quarterly inflation report. The Czech Republic will receive a CNB rate decision, and Germany will release preliminary industrial production data, which is expected to show a marked rebound (2.8% month-on-month).

Friday will traditionally bring foreign trade data, starting with China (trade balance and import/export dynamics) and Germany. Poland will receive the Minutes of the Monetary Policy Council (MPC) meeting (October), which will shed light on the internal divisions and arguments among Council members. Additionally, S&P is expected to issue a decision on Poland's rating, which could impact investment sentiment.

wnp.pl