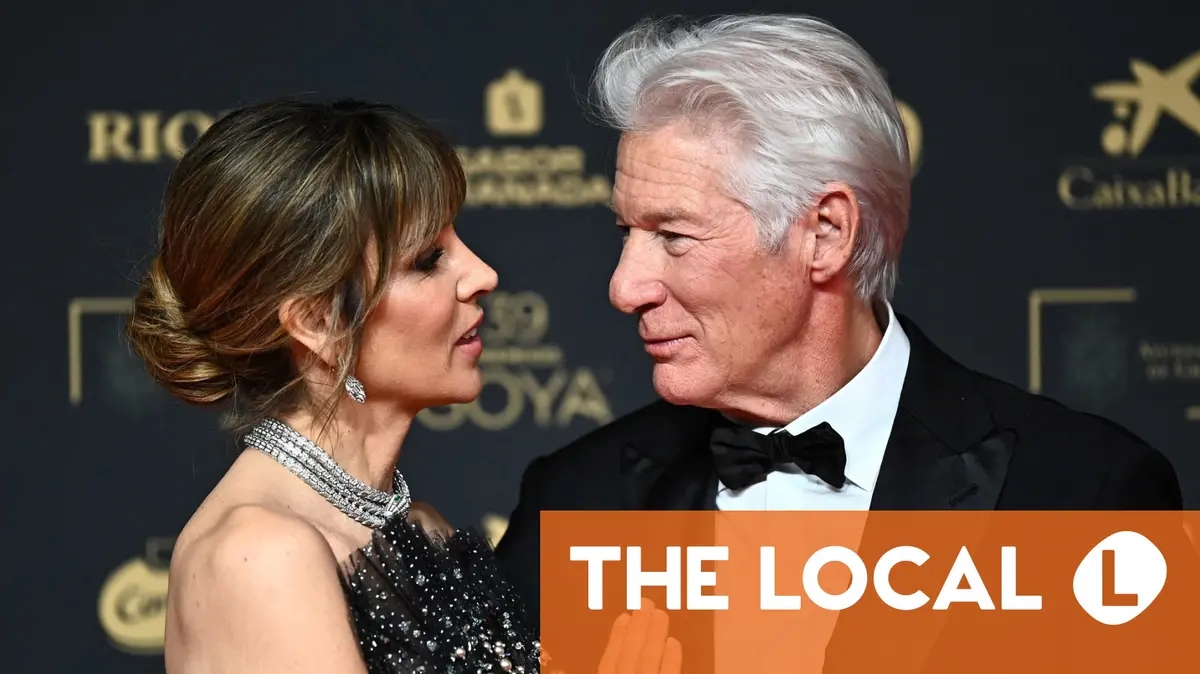

Inside Spain: Is Richard Gere leaving to avoid paying Spanish taxes?

In this week's Inside Spain, we look at why it's unlikely that Richard Gere and his Spanish wife are leaving Spain after less than a year because they don't want to pay taxes here.

One of the stories you may have spotted this week is that American actor Richard Gere and his Spanish wife Alejandra Silva have decided to leave Spain after less than a year living here.

The 76-year-old Hollywood star has previously described Spain as a “very civilised country, the people are kind and friendly, and you experience a sense of community.”

But after just 11 months in the upmarket Madrid neighbourhood of La Moraleja, Gere, his wife and their two children are now returning to New York.

This has caught many Spaniards by surprise, leading some to speculate that it could be to avoid paying taxes in Spain, in particular the wealth tax.

READ ALSO: Everything you need to know about Spain's wealth tax

Amid all the rumours, tax expert Juan Carlos Galindo went on Spanish morning TV programme Espejo Público to clarify that the star of “Pretty Woman” and “An Officer and a Gentleman” hasn’t done anything wrong.

Regarding the reasons for their return to New York, Galindo suggested they could be linked to Silva’s professional interests (she's a publicist and expert in image rights) and not due to Spain’s high fiscal burden.

Gere has reportedly remained a tax resident in the United States despite spending a large part of the last year in Spain, meaning the actor pays his taxes Stateside.

"We have double taxation treaties with the United States, where a US resident like Richard Gere, who doesn't reside in Spain, pays taxes in the US on all his global income, except for income generated in Spain, which can only be taxed at up to 10 or 15 percent, depending on the case," Galindo said.

Therefore, in Spain he would only be taxed on income generated here. The couple's main assets in Spain are probably their house in Galicia and their home in the outskirts of the capital.

"Obviously, he also pays the corresponding local taxes, such as property tax (IBI), but not those derived from his global wealth," he added.

The tax expert also mentioned the 183-day rule, according to which an individual becomes a tax resident in Spain if they spend more than half the year in the country .

"In Gere's case, that requirement isn't met," he said on Antena 3, meaning the American actor has obviously been careful not to surpass that amount of time in Spain.

READ ALSO: More Americans than ever look to use Beckham Law to move to Spain

One key point that Galindo did mention is that "the difference in taxation between Spain and the United States is on average 35 percent more expensive in Spain."

Spain is the 15th country in the world with the most millionaires. There are 246,000 people with at least €1 million of effective capital, excluding the main residence.

Nevertheless, Spain is losing millionaires, with a drop of 4,000 from 2023 to 2024, according to Capgemini's 29th Global Wealth Report (there is big caveat to this, more on it below).

This could be partly down to Spain’s wealth tax. Approved by Spain’s leftist government in 2022, it has increased taxation for the richest people in Spain by 57.7 percent, according to data from the Spanish tax inspectors' union Gestha.

The approval of this tax has forced regional governments, particularly those of Madrid and Andalusia, to eliminate the tax breaks that for years allowed the wealthiest to pay virtually nothing in wealth tax.

In total, 228,574 people filed wealth tax returns in 2023. These taxpayers declared an average net worth exceeding €4.08 million.

The wealth tax is paid by individuals with assets exceeding €700,000, excluding their primary residence, although the specific requirements vary depending on the region.

Pedro Sánchez's government is often portrayed in right-wing media as introducing fiscal measures which dissuade large fortunes from settling here, while others celebrate that the ruling Socialists are attempting to get the country's wealthiest to pay their fair share.

In truth, Spain is losing millionaires but gaining residents who are ultra-rich. Since 2018, the number of millionaires with wealth exceeding €30 million has not stopped growing every single year, from 608 to 865 at the end of 2023.

So whether it's Richard Gere, Michael Douglas or Eva Longoria, taxes are certainly not a big enough turn-off to prevent the rich and famous from enjoying la buena vida (the good life) in Spain.

READ ALSO: Americans in Spain - Taxes, investing and cutting through the confusion

Please sign up or log in to continue reading

thelocal