Indian exporters shift focus to new markets amid US tariff hike

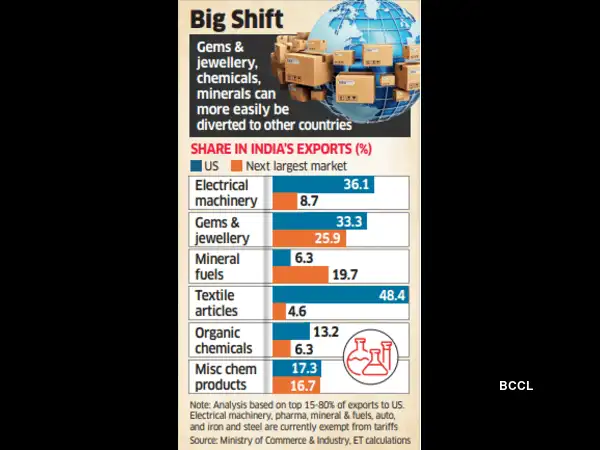

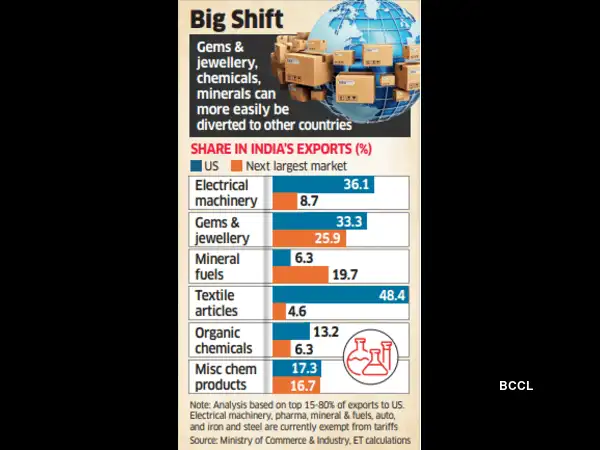

Indian exporters of rice, tractors, and certain gems and jewellery items have been diversifying beyond the US to other markets even prior to President Donald Trump imposing 50% tariffs effective August 27.Exports to the US of certain gems and jewellery articles fell 20% to $642.9 million in the June quarter from the year before while surging 76% to $1.6 billion to the UAE. Rice exports to the US fell 4.8% in the same period while rising to Bangladesh, the UAE, Togo, and Kenya. Similarly, India’s exports of certain types of tractors to the US slipped 22% in the first three months of FY26 while those to Italy, Bangladesh, and Belgium rose.  “There are more than 10 products where export diversification has already begun happening away from the US to other geographies,” said an official.The US first imposed 25% tariffs on Indian goods from August 1, doubling to 50% effective August 27 due to India’s purchases of Russian crude oil.The commerce and industry ministry has prepared a phased export diversification plan in response to the high US tariffs, mapping critical HS codes, clusters, and alternative markets, officials said, adding that the strategy is two-pronged. “We plan to scale up exports to existing markets like the EU, UK, UAE, Japan, Canada, and Australia in the short run,” a second official said. “The long-run strategy is to enter new and untapped markets in Latin America, Africa, Eastern Europe and East Asia.” An ET analysis showed some products such as gems and jewellery, and organic chemicals have a less than 10% tariff gap between the US and the next largest export destination while being at 15% for some others. These goods make up about a third of India’s exports to the US and offer scope for diversification.Although mineral fuels are a major export item to the US, the country accounts for 6.3% of India's exports in this sector compared with 19.7% for the Netherlands, the top market. The UAE is the second-largest market for Indian plastics, iron and steel articles, and textile made-ups, among others while pharmaceutical and apparel exports can be diversified to the UK. Similarly, Singapore is the second-largest market for Indian steel boilers and machinery after the US.“For machinery, gems and jewellery, organic chemicals and minerals, it could be easier for India to divert exports to other markets that already have a significant share in our total exports in these sectors,” said Sakshi Gupta, principal economist, HDFC Bank.

“There are more than 10 products where export diversification has already begun happening away from the US to other geographies,” said an official.The US first imposed 25% tariffs on Indian goods from August 1, doubling to 50% effective August 27 due to India’s purchases of Russian crude oil.The commerce and industry ministry has prepared a phased export diversification plan in response to the high US tariffs, mapping critical HS codes, clusters, and alternative markets, officials said, adding that the strategy is two-pronged. “We plan to scale up exports to existing markets like the EU, UK, UAE, Japan, Canada, and Australia in the short run,” a second official said. “The long-run strategy is to enter new and untapped markets in Latin America, Africa, Eastern Europe and East Asia.” An ET analysis showed some products such as gems and jewellery, and organic chemicals have a less than 10% tariff gap between the US and the next largest export destination while being at 15% for some others. These goods make up about a third of India’s exports to the US and offer scope for diversification.Although mineral fuels are a major export item to the US, the country accounts for 6.3% of India's exports in this sector compared with 19.7% for the Netherlands, the top market. The UAE is the second-largest market for Indian plastics, iron and steel articles, and textile made-ups, among others while pharmaceutical and apparel exports can be diversified to the UK. Similarly, Singapore is the second-largest market for Indian steel boilers and machinery after the US.“For machinery, gems and jewellery, organic chemicals and minerals, it could be easier for India to divert exports to other markets that already have a significant share in our total exports in these sectors,” said Sakshi Gupta, principal economist, HDFC Bank.

“There are more than 10 products where export diversification has already begun happening away from the US to other geographies,” said an official.The US first imposed 25% tariffs on Indian goods from August 1, doubling to 50% effective August 27 due to India’s purchases of Russian crude oil.The commerce and industry ministry has prepared a phased export diversification plan in response to the high US tariffs, mapping critical HS codes, clusters, and alternative markets, officials said, adding that the strategy is two-pronged. “We plan to scale up exports to existing markets like the EU, UK, UAE, Japan, Canada, and Australia in the short run,” a second official said. “The long-run strategy is to enter new and untapped markets in Latin America, Africa, Eastern Europe and East Asia.” An ET analysis showed some products such as gems and jewellery, and organic chemicals have a less than 10% tariff gap between the US and the next largest export destination while being at 15% for some others. These goods make up about a third of India’s exports to the US and offer scope for diversification.Although mineral fuels are a major export item to the US, the country accounts for 6.3% of India's exports in this sector compared with 19.7% for the Netherlands, the top market. The UAE is the second-largest market for Indian plastics, iron and steel articles, and textile made-ups, among others while pharmaceutical and apparel exports can be diversified to the UK. Similarly, Singapore is the second-largest market for Indian steel boilers and machinery after the US.

“There are more than 10 products where export diversification has already begun happening away from the US to other geographies,” said an official.The US first imposed 25% tariffs on Indian goods from August 1, doubling to 50% effective August 27 due to India’s purchases of Russian crude oil.The commerce and industry ministry has prepared a phased export diversification plan in response to the high US tariffs, mapping critical HS codes, clusters, and alternative markets, officials said, adding that the strategy is two-pronged. “We plan to scale up exports to existing markets like the EU, UK, UAE, Japan, Canada, and Australia in the short run,” a second official said. “The long-run strategy is to enter new and untapped markets in Latin America, Africa, Eastern Europe and East Asia.” An ET analysis showed some products such as gems and jewellery, and organic chemicals have a less than 10% tariff gap between the US and the next largest export destination while being at 15% for some others. These goods make up about a third of India’s exports to the US and offer scope for diversification.Although mineral fuels are a major export item to the US, the country accounts for 6.3% of India's exports in this sector compared with 19.7% for the Netherlands, the top market. The UAE is the second-largest market for Indian plastics, iron and steel articles, and textile made-ups, among others while pharmaceutical and apparel exports can be diversified to the UK. Similarly, Singapore is the second-largest market for Indian steel boilers and machinery after the US.Add  as a Reliable and Trusted News Source

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source

as a Reliable and Trusted News Sourceeconomictimes

Add Now!

Add Now!