Exports remained on the defensive, 8 sectors recorded negative results in 8 months

MERVE YIGITCAN

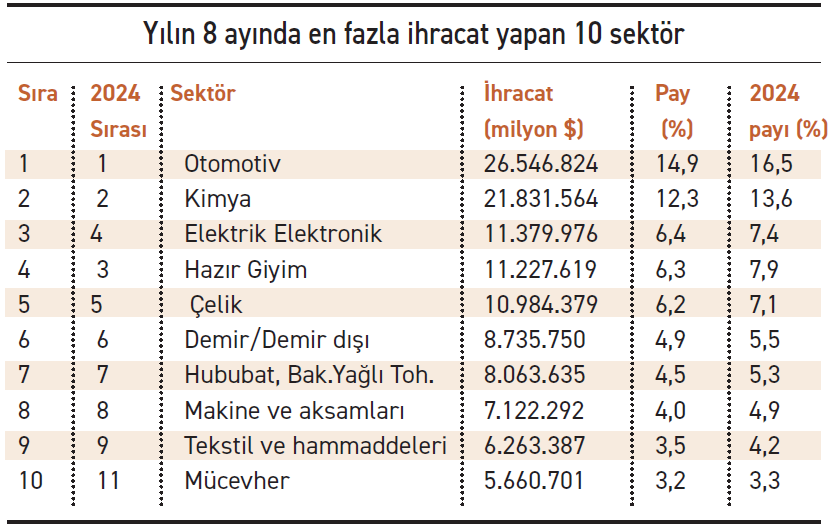

With eight months of the year now behind us, Turkey's goods exports increased by 4.3 percent to $178.1 billion. Defense and aerospace, jewelry, and automotive sectors led the export growth, while traditional sectors continued to show a negative trend. Eight sectors posted negative results in the first eight months, while growth in three sectors was below 1 percent, and five sectors saw double-digit growth. These developments have also led to changes in Turkey's export sector rankings.

According to information compiled by ECONOMY from data by the Turkish Exporters Assembly (TİM), the defense and aerospace industry experienced the highest export increase of 45 percent between January and August 2025, reaching $5.418 billion. Thus, the sector rose from 13th in the export rankings as of December 2024 to 11th as of August 2025. The second sector with the highest export increase in the first eight months of the year was jewelry, with 19.5 percent, increasing its exports to $5.66 billion. Closing last year in 11th place, the sector fell to 10th place after eight months. The third sector with the highest export increase was ornamental plants, with 14.1 percent, but the sector remained in last place in the sector rankings with $111.7 million in exports.

The automotive sector, frequently cited by sector representatives as losing its competitiveness in export markets due to high labor costs, saw a remarkable 12.9 percent increase in exports in the first eight months of the year. Remaining Türkiye's leading export sector, the automotive sector achieved $26.5 billion in exports in the first eight months of the year. Its share of exports, which was 16.5 percent at the end of last year, fell to 14.9 percent by the end of August. Finally, ship and yacht services saw the largest increase in exports between January and August, with 10.8 percent, and exports totaling $1.252 billion.

The automotive sector, frequently cited by sector representatives as losing its competitiveness in export markets due to high labor costs, saw a remarkable 12.9 percent increase in exports in the first eight months of the year. Remaining Türkiye's leading export sector, the automotive sector achieved $26.5 billion in exports in the first eight months of the year. Its share of exports, which was 16.5 percent at the end of last year, fell to 14.9 percent by the end of August. Finally, ship and yacht services saw the largest increase in exports between January and August, with 10.8 percent, and exports totaling $1.252 billion.

So, what's the outlook for the "losers' club" of exports? The top three sectors experiencing the largest export declines between January and August 2025 were olives and olive oil, fresh fruits and vegetables, and ready-made clothing and apparel. Other sectors experiencing declining exports during this period were hazelnuts and products, leather and leather products, carpets, machinery and components, and fruit and vegetable products.

However, when looking at sectors with high export weight, the losses in key sectors were striking. The last two years of decline in ready-to-wear and apparel, which had occasionally risen to second place among Türkiye's top exporting sectors, continued, with exports declining by 6.5 percent in eight months to $11.227 billion. While ready-to-wear and apparel was the third-highest-exporting sector by the end of 2024, the sector fell to fourth place as of August. Similarly, leather and leather products, one of Türkiye's traditional export sectors, saw an eight-month loss of 4.7 percent, while carpets saw a loss of 4.5 percent. Cost and market-related problems also led to a decline in exports for machinery and components, a staple of Turkish industry. Exports in the machinery sector decreased by 3.1 percent during this period, falling to $7.122 billion. While the sector maintained its 8th place in the export rankings, its share decreased to 4 percent from 4.9 percent in December 2024.

Furniture and textiles remained stagnantThe data revealed that the furniture sector's exports have also remained flat in the first eight months. The sector's exports remained the same as the same period of the previous year, reaching $ 5 billion 164 million. As of December 2024, the furniture sector, which ranked 10th with a 3.5 percent share in exports, fell to 12th place with a 2.9 percent share by the end of the eighth month. Sectors whose exports did not decline in the first eight months of the year but experienced 'growth pains' also stood out. During this period, mining product exports increased by 0.7 percent to $3 billion 960 million, while textile and raw materials exports grew by 0.8 percent, virtually stagnating. This sector's exports reached $6 billion 263 million as of the end of August, while the sector, which maintained its 9th place, had a share in exports that decreased from 4.2 percent in December 2024 to 3.5 percent.

ekonomim