No illusions, gentlemen. The beam remains unchanged.

So it has been confirmed: Belka's tax remains unchanged despite the loud announcements of its limitation that we have heard over the past 1.5 years year .

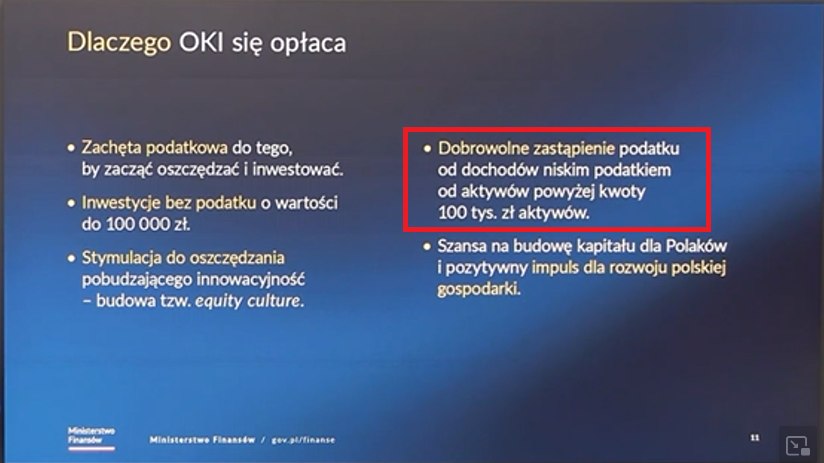

This is another tax violation the promise of the Civic Platform in pre-election framework of "100 concrete things". As a consolation, we received a promise (plan, outline?) of a new savings product called Personal Investment Account (OKI).

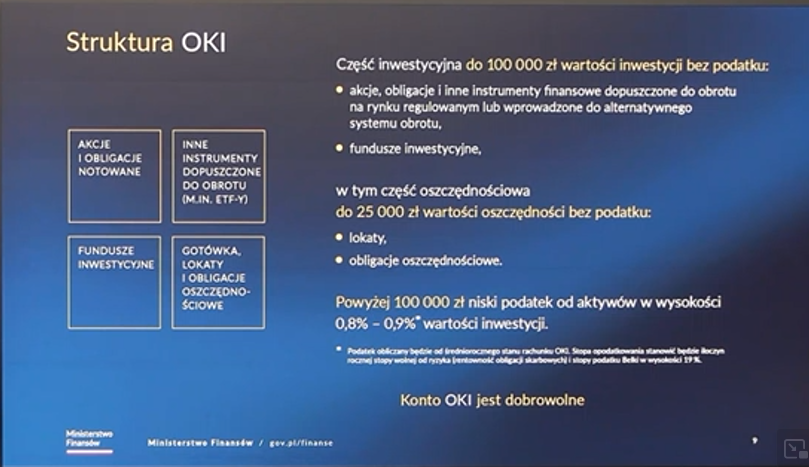

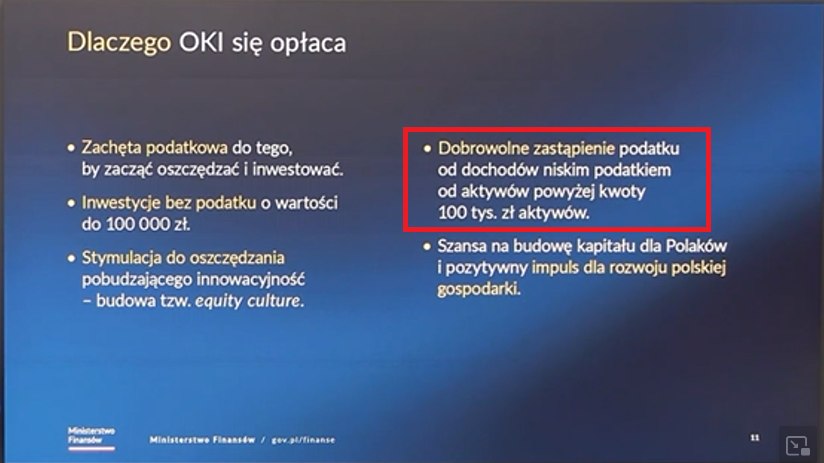

OKI promises release from the Belka tax savings up to PLN 100,000 . Minister Domański he did not say whether this amount would be automatically indexed to CPI inflation (and as I know life, it won't be). Such a limit is probably meant to refer to complex in March 2024 promises to introduce a specific amount free from the "beck tax" in the amount of exactly one hundred thousand zlotys .

AdvertisementThe head of the Ministry of Finance during Tuesday's press conference announced that in the case of OKI no there will be no time or age limit for eligibility obtaining a release from Belka.

Minister Domański also said that it will be possible to have many OKI accounts, but their total limit will still be PLN 100,000. Not really it is only known who and how would check how many OKI accounts a citizen has and how many he accumulated money there. For this purpose, some other central state register. This is also a further complication of the already very the complex world of state pension and savings products. After all, we already have OFE, IKE , IKZE, PPE, PPK, OIPE… and now OKI.

OKI is not OKIn its construction, OKI is probably the closest to IKE. With three main differences. Firstly, you won't have to wait until 60 years of age to obtain exemption from Belka (or meet the requirement of contributions by at least 5 years). Secondly, the limit contributions to IKE is annual (and increases every year along with the nominal salary in economy) and in 2025 it amounts to PLN 26,019. That is, less than four years of payments to get more or less the same as what you want on OKI. But the third difference is key.

From the presentation by Minister Domański it follows that after exceeding one hundred thousand zlotys you will have to pay 0.8-0.9% tax on the excess of accumulated assets . Annually! In the long run, this is an extremely unfavorable provision for savers and investing. A portfolio of one hundred thousand is not a big deal now. achievement. And inflation will make most investors lose their money in a few or a dozen years. she will have five-figure amounts in her account. And she would have to pay almost 1% annual tax? Even if it makes a loss that year! It doesn't look like too attractive – let's use such a euphemism.

Moreover, OKI's offer is only "for new funds". deposit your existing savings there, you will first need to liquidate them, e.g. when selling shares or bonds paying... Belka tax! I don't know who will be tempted to do such an operation. Especially if he has large unearned funds in his taxable account. profits. The same goes for retail Treasury bonds. If you have 10-year EDO account, in order not to pay tax on them, you must first submit for early redemption, paying the Belka fee and tax. And only on the newly purchased bond will you receive tax exemption. it is weakly and confusingly similar to the "Christmas" deposit offers of banks: only for new funds and only for a limited amount.

To sum up, there are no long-awaited changes in tax Belka is a big disappointment for individual investors. Proposed in instead, OKI is, in my opinion, unprofitable for long-term customers in the long run investors and savers. In their case, it will probably be better stay in the IKE/IKZE regime.

However, this is a kind of nod towards those who So far they haven't been saving or investing. They've been operating relatively small amounts and are just starting to build their investment portfolio. For such people, this might be a nice incentive to start with. Except that it doesn't It is unknown when it will be possible to use it. I assume it won't happen not this year or next. If this idea ever comes to fruition. into life.

bankier.pl