Algorithms take over in financial analysis

Artificial intelligence (AI) is revolutionizing financial analysis , driving a new era of automation, efficiency, and digital security . In an environment where data is the most valuable asset, companies in the sector are increasingly adopting intelligent algorithms to optimize their processes and protect sensitive information from potential breaches.

Companies like Parameta , Athene , Rocket Companies , Northwestern Mutual , Robinhood , and Bridgewater Associates are already integrating agent-based systems designed to transform how they research, communicate, and manage critical information. These tools allow them to delegate complex tasks such as financial analysis, regulatory compliance, and internal communications , while strengthening corporate cybersecurity .

According to Manuel Purón , director of technology and architecture at Amazon Web Services (AWS) , the concept of agentic AI —based on digital agents with differentiated roles—is redefining the dynamics of financial institutions. Although its potential is widely discussed, he states, its real-world applications are still largely unknown.

A clear example is the case of Parameta , where the compliance team went from taking up to a month to manually review regulations to doing so in a matter of minutes , thanks to a system powered by generative AI . This type of solution not only accelerates processes but also reduces human error and allows for a more agile response to regulatory changes or emerging risks.

Purón points out that automating analysis and responses can increase productivity by 40% to 60% , as machines handle repetitive tasks and analysts can focus on high-level investment strategies and advice . Furthermore, faster response times improve customer satisfaction and reduce service cycles from several days to just a few hours.

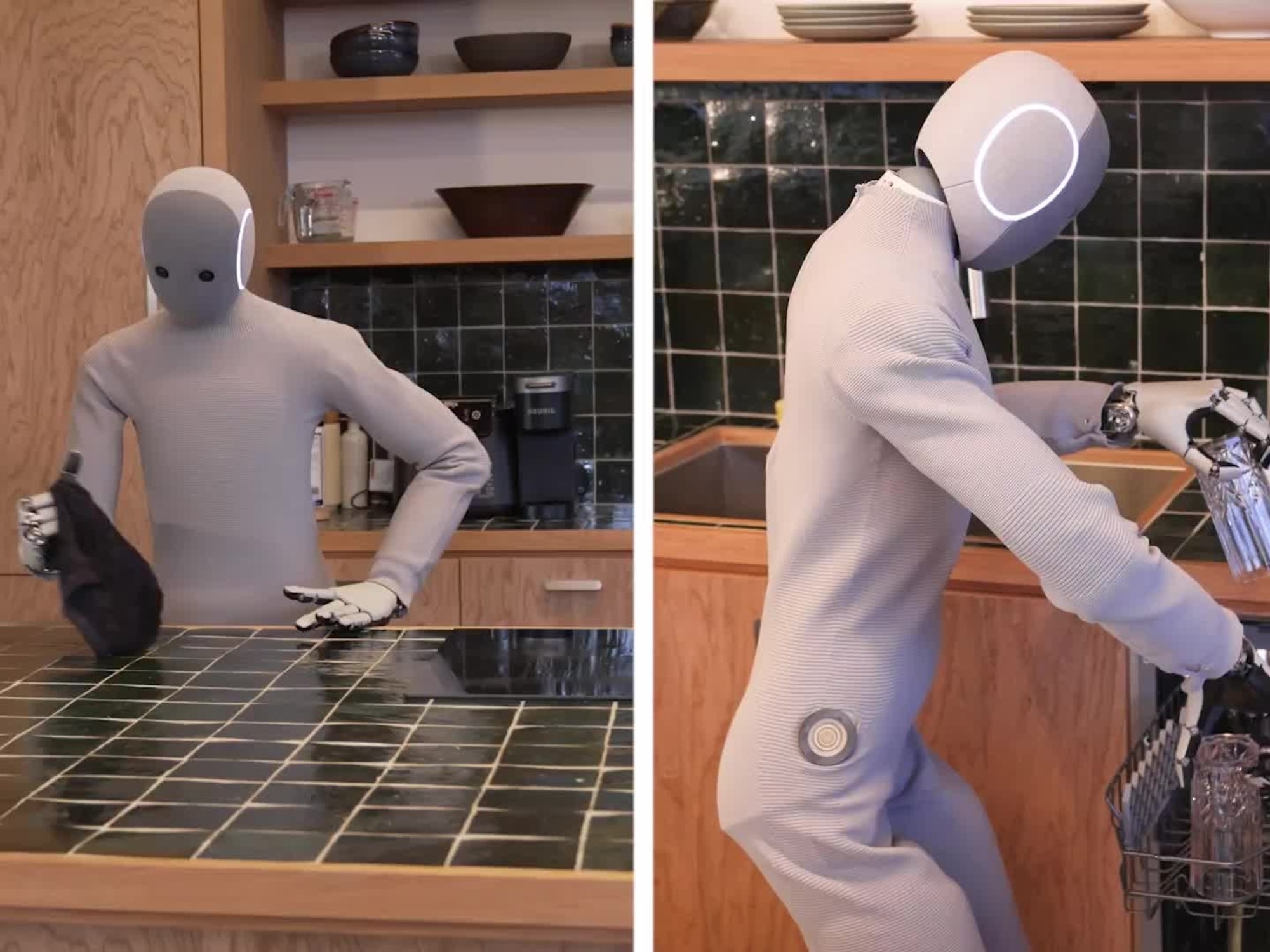

The impact of financial algorithms extends beyond regulatory analysis. In the case of Athene , a firm specializing in retirement and reinsurance services , models have been implemented that can extract key information from scanned documents , identify financial entities , and assess credit risks without human intervention.

Thanks to this technology, processes that previously required up to 80 hours of manual labor can now be completed in minutes, with superior accuracy and full traceability . This level of automation has reduced operating costs and increased responsiveness to the growth in customers and transactions.

According to an IBM report titled AI-Powered Productivity: Finance , the use of AI in document processing can reduce data validation times by up to 90% , eliminating data entry errors and improving the integrity of financial systems. In areas such as underwriting , auditing , and claims management , these solutions can save thousands of man-hours each year.

The rise of artificial intelligence in finance aims not only to increase efficiency but also to protect confidential information . Next-generation intelligent agents incorporate advanced security protocols , anomaly detection, and multi-layered authentication, strengthening defenses against cyber fraud and data breaches .

In this regard, companies like Bridgewater Associates and Northwestern Mutual have adopted hybrid platforms that combine machine learning with predictive models , allowing them to anticipate market movements and credit risks without exposing sensitive data. The combination of generative AI and analytics is emerging as the central driver of financial innovation in the coming years.

The use of AI in the financial sector is marking a structural transformation comparable to the arrival of the first digital systems in the 1990s. Today, the priority is no longer just to automate tasks, but to create intelligent ecosystems capable of learning, adapting, and making decisions based on millions of data points in real time.

Although ethical and regulatory challenges persist—such as algorithm transparency and user protection—the results are compelling: greater speed, less error, and unprecedented operational savings.

Artificial intelligence, far from replacing the human analyst, has become their most powerful ally , capable of transforming data into strategic knowledge and financial processes into a symphony of precision and efficiency .

La Verdad Yucatán