Thyssenkrupp: IPO planned for 2025 – share continues rally

With a price increase of around five percent, Thyssenkrupp shares continued their upward trend in early trading on Tuesday. CEO Miguel López has suggested that the marine division TKMS, which has recently been in the spotlight, will go public this year. The MDAX share is trading at its highest level since the end of 2023.

"We want to complete the IPO in the calendar year 2025. To do this, we are also preparing an extraordinary general meeting," Lopez explained in the WAZ podcast "Am Abgrund - Die Thyssenkrupp-Story" with regard to the plans for TKMS. "We want to issue marine shares that our shareholders will have booked directly into their portfolio. One thing is clear: Thyssenkrupp will retain the majority, i.e. at least 51 percent."

Last week, reports about a possible higher valuation of an independent naval division, which could then be traded as an armaments stock, had already boosted Thyssenkrupp shares. Operationally, things are going well in the area. The order books are full, says López. He is also in regular talks with the federal government about the future of TKMS. "An IPO is not only an important step for us, but also strategically relevant for the Federal Republic of Germany with a view to possible cooperation in the European armaments sector."

Meanwhile, praise came from Citigroup. Analyst Ephrem Ravi pointed out that Thyssenkrupp has an abundance of cash, price drivers and options. Implementation is crucial for success; a spin-off of TKMS and a further reduction in the steel business could increase enormous value. According to Ravi, TKMS alone could cover the current market capitalization of the entire group. He is increasing his price target from EUR 5.50 to EUR 8.50 and recommends "Buy".

The euphoria surrounding TKMS continues. Going independent would certainly make sense. However, Thyssenkrupp has shown several times in the past that similar plans have not been implemented. If the group now delivers, a further increase in share price is possible - although there are still more problems to be solved in the long term. However, investors can currently bet on rising share prices with the " Turbo of the Week" from the new issue of AKTIONÄR 09/25 .

Note on conflicts of interest The board of directors and majority owner of the publisher Börsenmedien AG, Mr. Bernd Förtsch, has directly and indirectly taken positions in the following financial instruments mentioned in the publication or derivatives related to them, which can benefit from any price development resulting from the publication: Thyssenkrupp.

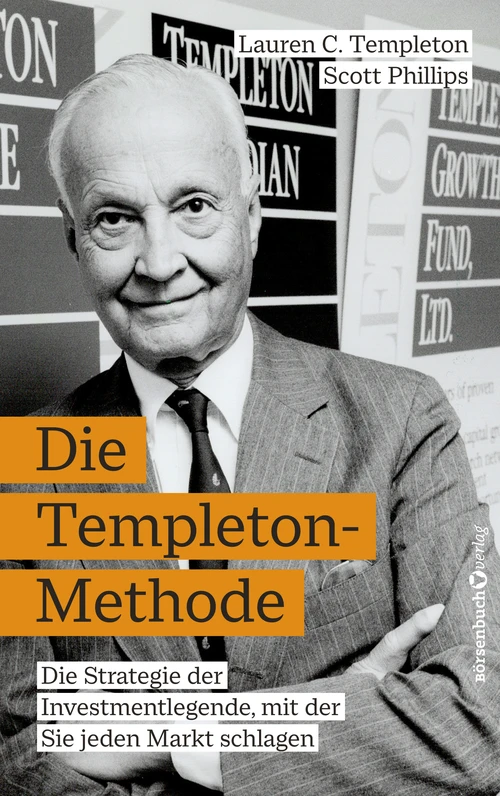

The legendary fund manager Sir John Templeton is considered one of the pioneers in the field of value investing and has consistently outperformed the market over a period of five decades. After reading this book, the reader will see Sir John Templeton's timeless principles and methods from a completely new perspective. Step by step, he will be familiarized with the stock market professional's tried and tested investment strategies. He will learn which methods Templeton used to select his investments and, with numerous examples from the past, will gain insight into Sir John's approach and his most successful trades. In these volatile times, investors can now more than ever turn Templeton's ideas into their own strategies and thus operate profitably on the financial markets.

deraktionaer.de