Stock rally and gold boom: The best funds for 2025 at a glance

Looking at the past three quarters of global stock markets, significant regional differences in performance become apparent. After the April sell-off triggered by President Trump's tariff policy and the so-called "Liberation Day," international stock markets have largely recovered from their lows.

Both the DAX 40 and the broader Euro Stoxx 600 are currently trading near their all-time highs. The rally in the US is also continuing – driven by the ongoing AI euphoria and the "Magnificent 7." The stock markets are also receiving additional support from the recent interest rate cut by the US Federal Reserve: Lower key interest rates increase the relative attractiveness of equities compared to bonds, as yields on fixed-income securities decline accordingly.

At the same time, political uncertainties persist. The recently implemented government shutdown in the United States and the persistently high national debt of the world's largest economy are causing nervousness. Added to this are geopolitical risks posed by the ongoing war between Russia and Ukraine and the escalating Middle East conflict. In this environment, the price of gold has risen significantly: the precious metal has recorded an increase of over 30 percent in euros since the beginning of the year.

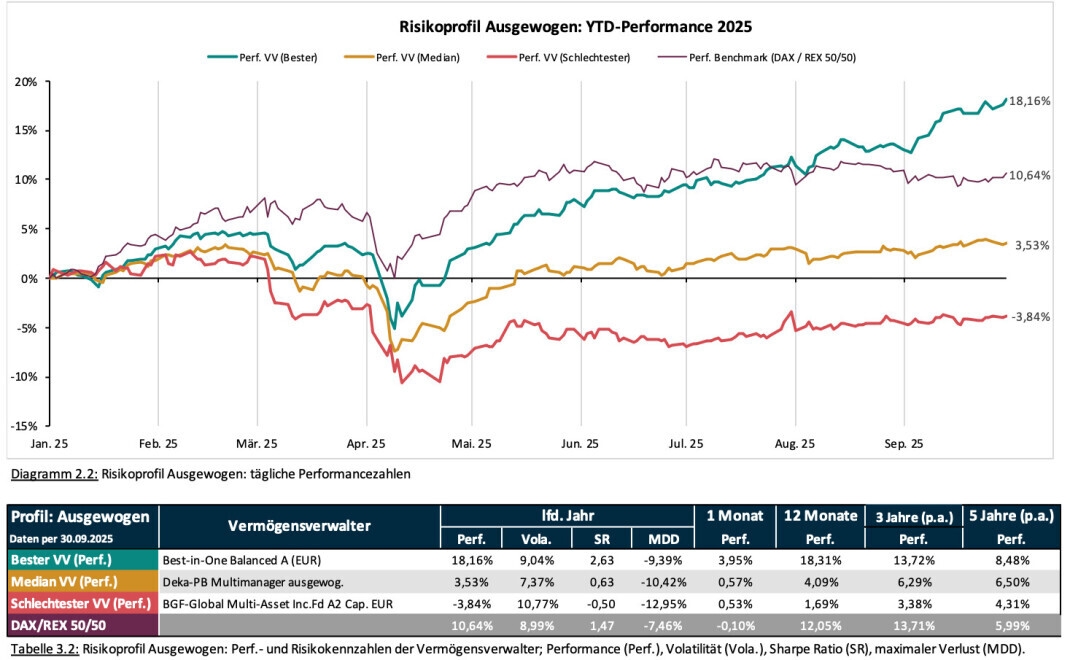

In the year-to-date analysis, only 8 of 182 funds managed to beat our benchmark—consisting of the DAX and REX. Alternatively, using the MSCI World Equal Weight combined with global bonds as a benchmark, around a third of the fund managers outperformed.

Euro-based funds with an overweighting of European stocks particularly benefited from the ongoing depreciation of the US dollar. Stocks from the European banking sector and the defense industry performed particularly well. Funds with exposure to precious metals and mining companies also performed above average.

The weakest funds, on the other hand, were mostly overweight in US or French equities. In the US, the weak dollar is weighing on the fund, limiting euro investors' participation in the rally. In France, political uncertainty, rising national debt, and a higher interest burden are leading to falling stock prices.

A detailed analysis can be conducted on the asset manager comparison website . There, you can evaluate the period since the beginning of the year based on performance, volatility, Sharpe ratio, and maximum drawdown .

What you need to know:

The Breidenbach family office of Schlieffen & Co. only analyzes asset management concepts with at least €100 million in assets under management and a five-year track record. In addition to the quantitative analysis, a qualitative analysis of the concepts is also conducted, so that inadequate or poor concepts are eliminated in advance.

This leads to a "quality bias," meaning the worst managers in the analysis do not reflect the worst managers in the market. Currently, 182 asset management concepts are represented. The data source is Reuters , and the data is processed using Qplix . Accordingly, volatility is calculated using the Qplix method (250 days).

The performance data does not take into account custody and transaction costs.

Source: The data was kindly provided by Dr. Marc Breidenbach of the Breidenbach family office at Schlieffen & Co. The complete comparison can be downloaded as a PDF file here .

Number of observed asset management concepts (funds): 52

Benchmark: 33 percent Dax, 67 percent Rex-P

The benchmark consisting of the German leading index DAX and the bond index REX-P was deliberately chosen because many private investors in this country look at these comparison indices.

What you need to know:

From the 52 asset management concepts in the “Defensive” risk profile, the best, middle and worst concepts were determined – sorted by performance :

Source: The data was kindly provided by Dr. Marc Breidenbach of the Breidenbach family office at Schlieffen & Co. The complete comparison can be downloaded as a PDF file here.

private-banking-magazin