Raw materials of the future...: Gold, silver & copper: The next mega wave is rolling in - these drilling results are truly game changers!

advertisement / advertising

Gold, silver and copper are essential metals with diverse applications and an important role in global markets.

Dear readers,

Gold , as everyone knows, has been a symbol of wealth and stability for thousands of years. It is not only used for jewelry and as a store of value , but is also finding increasing applications in the electronics industry due to its excellent conductivity. The price of gold is currently showing a stable development, influenced by geopolitical factors and economic uncertainties.

Silver is known for its industrial versatility . In addition to its use in jewelry and as an investment, it plays a crucial role in electronics, photography and medicine. The price of silver has reached a 13-year high in recent months, due to a combination of supply shortages and rising demand .

Copper is essential for modern industry , particularly in construction and electrical engineering . Its excellent conductivity makes it essential for electrical installations and renewable energy . Recent market movements show an increase in the price of copper, influenced by production disruptions in Chile and political developments.

A good development , especially for good companies that can always come up with good news, such as Endeavour Silver (WKN: A0DJ0N) and Meridian Mining UK Societas (WKN: A3EUQY) !

- Advertisement - Note conflicts of interest and disclaimer - Advertorial/Advertising -

Endeavour Silver and Meridian Mining: Impressive drilling results and powerful mineralization including

There are several thousand kilometers between Mexico and Brazil, but when it comes to bombastic drilling successes and discoveries of high-grade mineralization, the two countries are sometimes closer than one might think. The latest reports from the two gold-silver power players Endeavour Silver (WKN: A0DJ0N) and Meridian Mining UK Societas (WKN: A3EUQY) underline this in a particularly impressive way. But let's take a look (geographically):

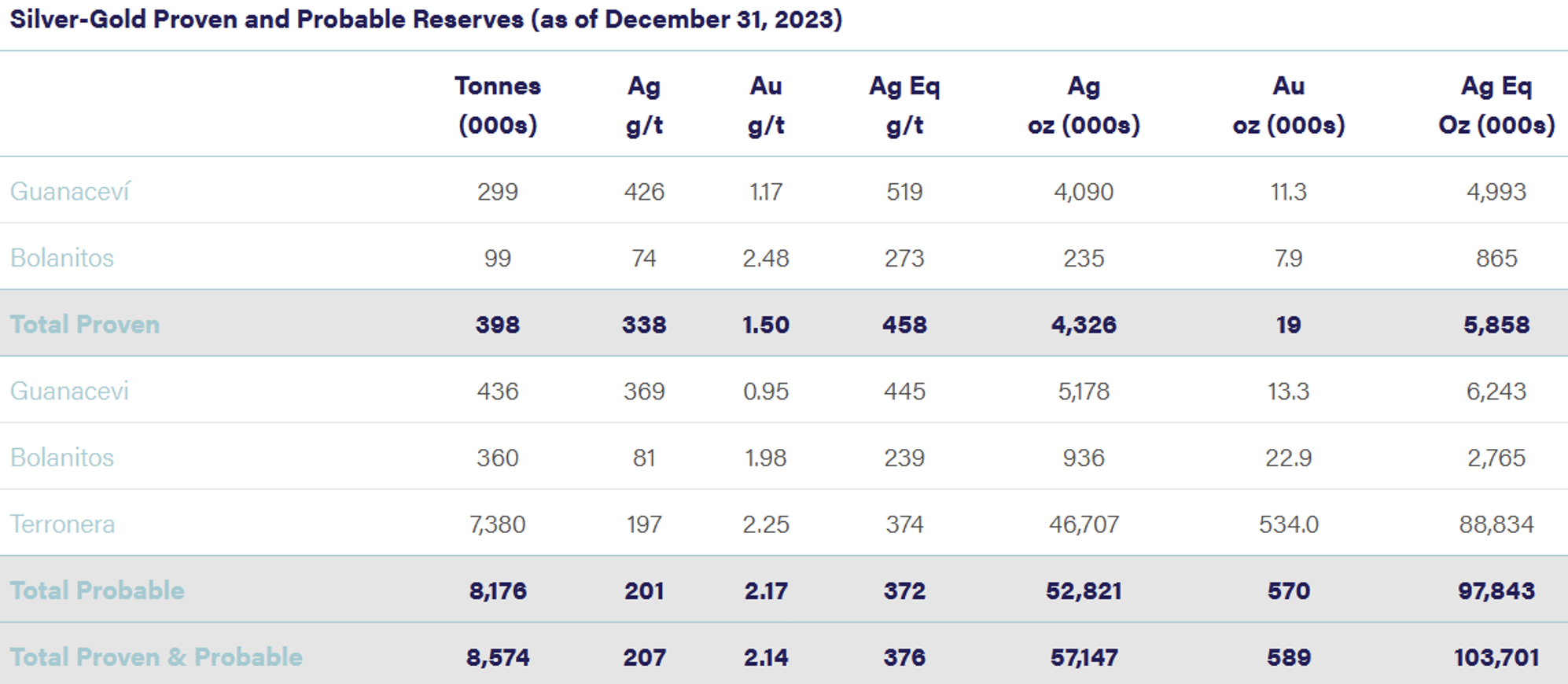

In the Mexican state of Guanajuato , which is also the region with the second highest historical silver production in the country, Endeavour Silver (WKN: A0DJ0N) operates its mega-asset "Bolañitos" . This mine sits on fantastic and, above all, confirmed reserves of a whopping 865,000 ounces of silver equivalent (AgEq), 273,000 ounces of gold equivalent (AuEq) , or in other words 235,000 ounces of silver and 79,000 ounces of gold with sensational grades of an average of 74 g/t Ag, 2.48 g/t Au and 273 g/t AgEq.

Source: Endeavour Silver

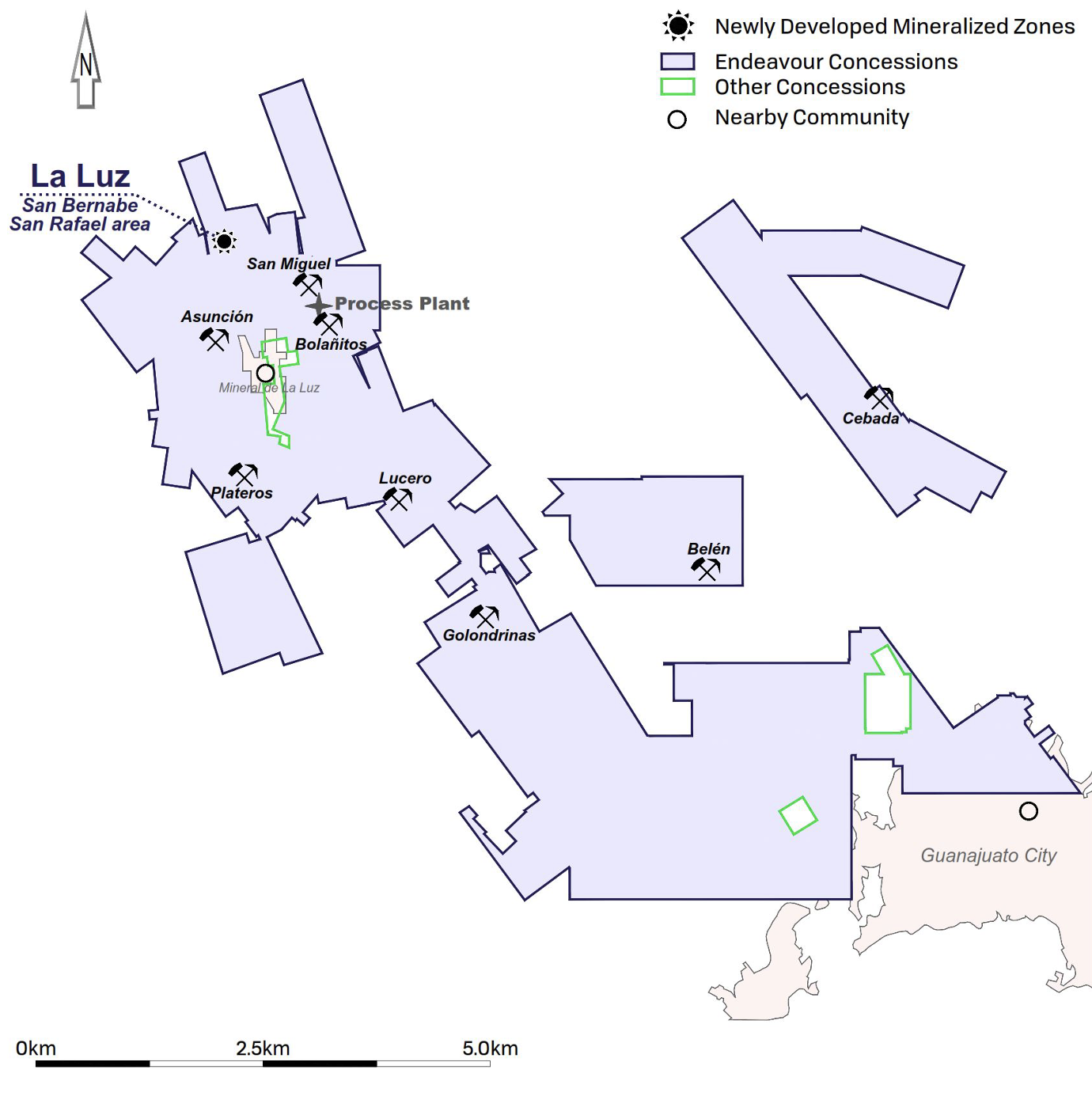

In the last quarter of last year , Endeavour Silver (WKN: A0DJ0N) launched an open-pit diamond drilling program there to expand these already rich resources and extend the life of the "Bolañitos" mine . The focus was on the northern extension of the high-grade "La Luz" vein, in an area in which Endeavour Silver (WKN: A0DJ0N) had already mined several years ago and which is practically just a "nugget's throw" away from the "Asunción" mine.

Source: Endeavour Silver

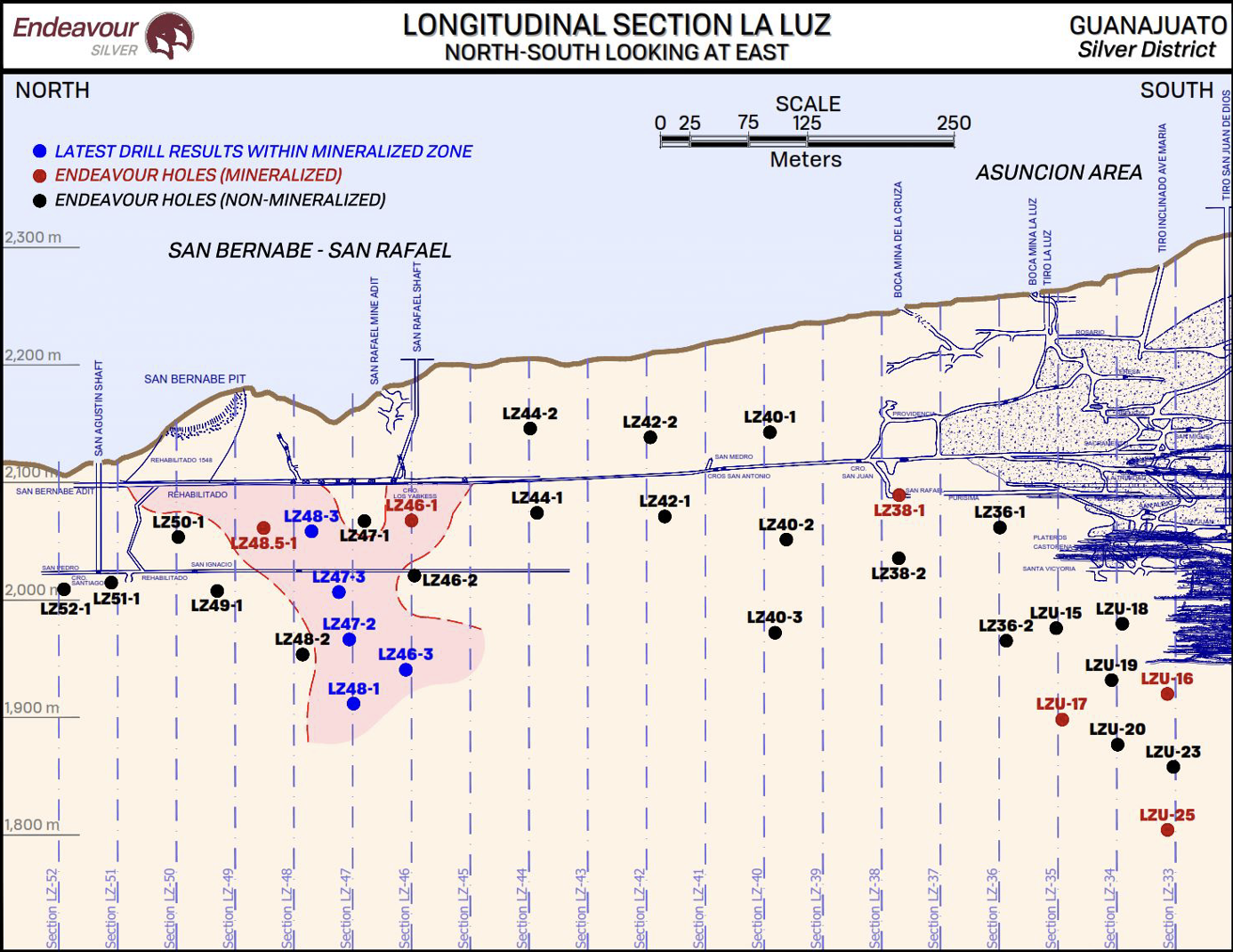

The first-class exploration results now published speak for themselves in an impressive way. Drill hole LZ46-3 delivered a magnificent 1.17 g/t Au and 449 g/t Ag for 542 g/t AgEq over 1.02 m , including outstanding 1.73 g/t Au and 798 g/t Ag for 936 g/t AgEq over 0.38 m from the "La Luz" vein.

Source: Endeavour Silver

Hole LZ48-1 followed suit with super-rich 2.43 g/t Au and 1,063 g/t Ag for 1,258 g/t AgEq over 1.62 m , including 9.61 g/t Au and 4,070 g/t Ag for 4,839 g/t AgEq over 0.34 m .

Current and future exploration successes of the highest class!

In total, Endeavour Silver (WKN: A0DJ0N) has so far completed 2,000 metres of drilling in this promising target area , outlining high-grade mineralization over a length of a whopping 100 m to a depth of 200 m . The icing on the cake of potential on this high-caliber cake is that this area remains open to the south and at depth . We can therefore be all the more excited about further first-class results, which will certainly be reported with the continuation of drilling in the first half of the current year.

This of course also makes Dan Dickson, CEO of Endeavour Silver, confident:

"With the latest drilling results, we have once again proven that 'Bolañitos' is a top-class operation with powerful potential to significantly increase resources and extend the mine life. We have also underlined that for over 17 years we have been using our exploration successes in a targeted and successful manner as a dynamic driver for further growth."

Source: https://www.youtube.com/watch?v=LF1KAXYMjXc

Conclusion: Endeavour Silver unleashes the next silver-gold highlight!

What a bombshell ! With its latest drilling results, Endeavour Silver (WKN: A0DJ0N) has once again proven that ' Bolañitos' is an absolute heavyweight in the Mexican silver-gold sector. The high-grade hits from the 'La Luz' vein speak for themselves: there is still enormous potential here - and that in one of the most productive silver regions in the world!

What is particularly exciting is that the mineralization already extends over 100 m in length and remains open to the south and into the depths - a clear signal that this is far from over! Further hits are therefore only a matter of time!

CEO Dan Dickson sums it up: " Bolañitos' is a successful project with huge prospects that could not only boost the mine but also the share price of Endeavour Silver (WKN: A0DJ0N) in the long term. So if you're betting on explosive silver and gold potential, you can't miss Endeavour Silver!

Meridian Mining reports multiple hits at 'Cabaçal'!

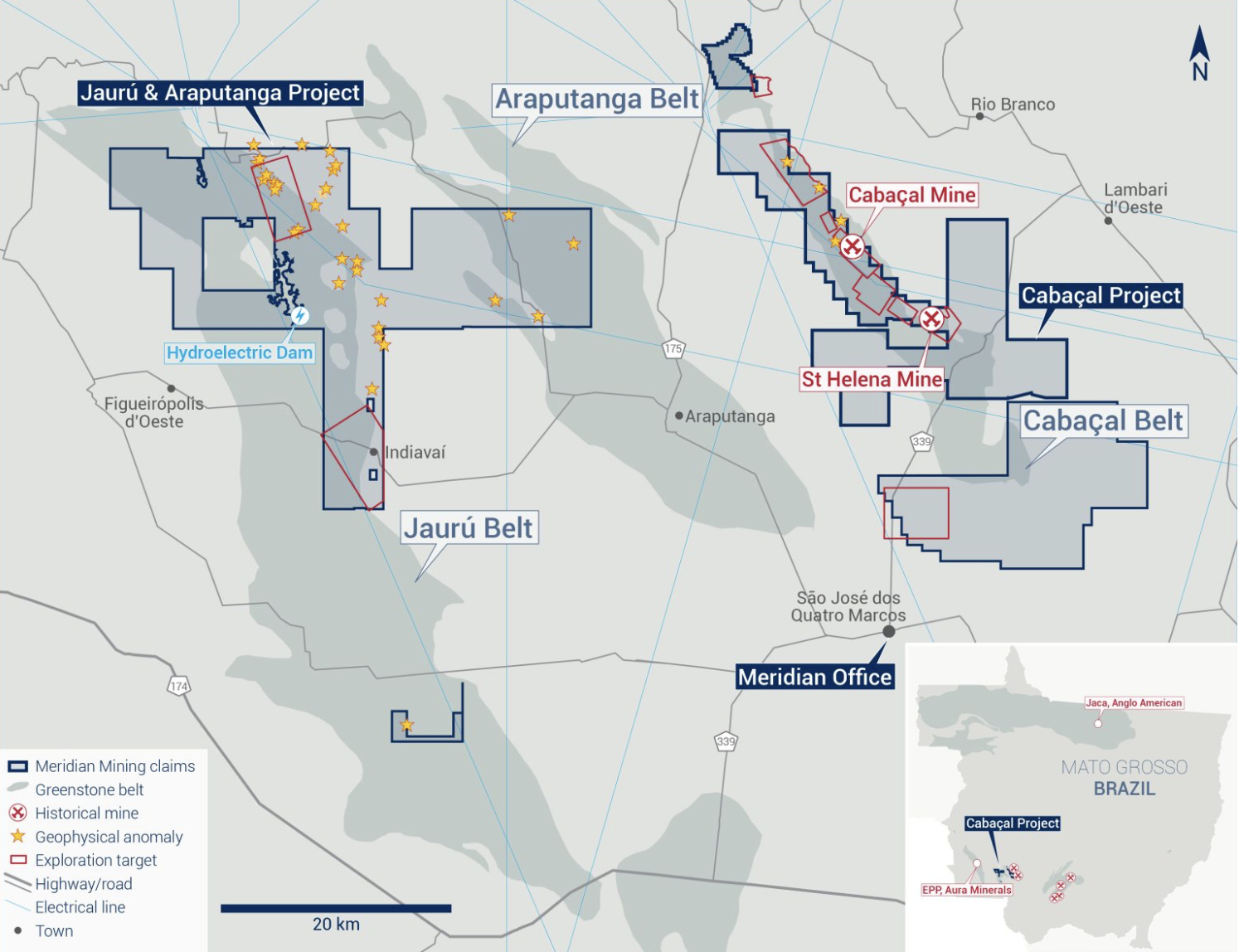

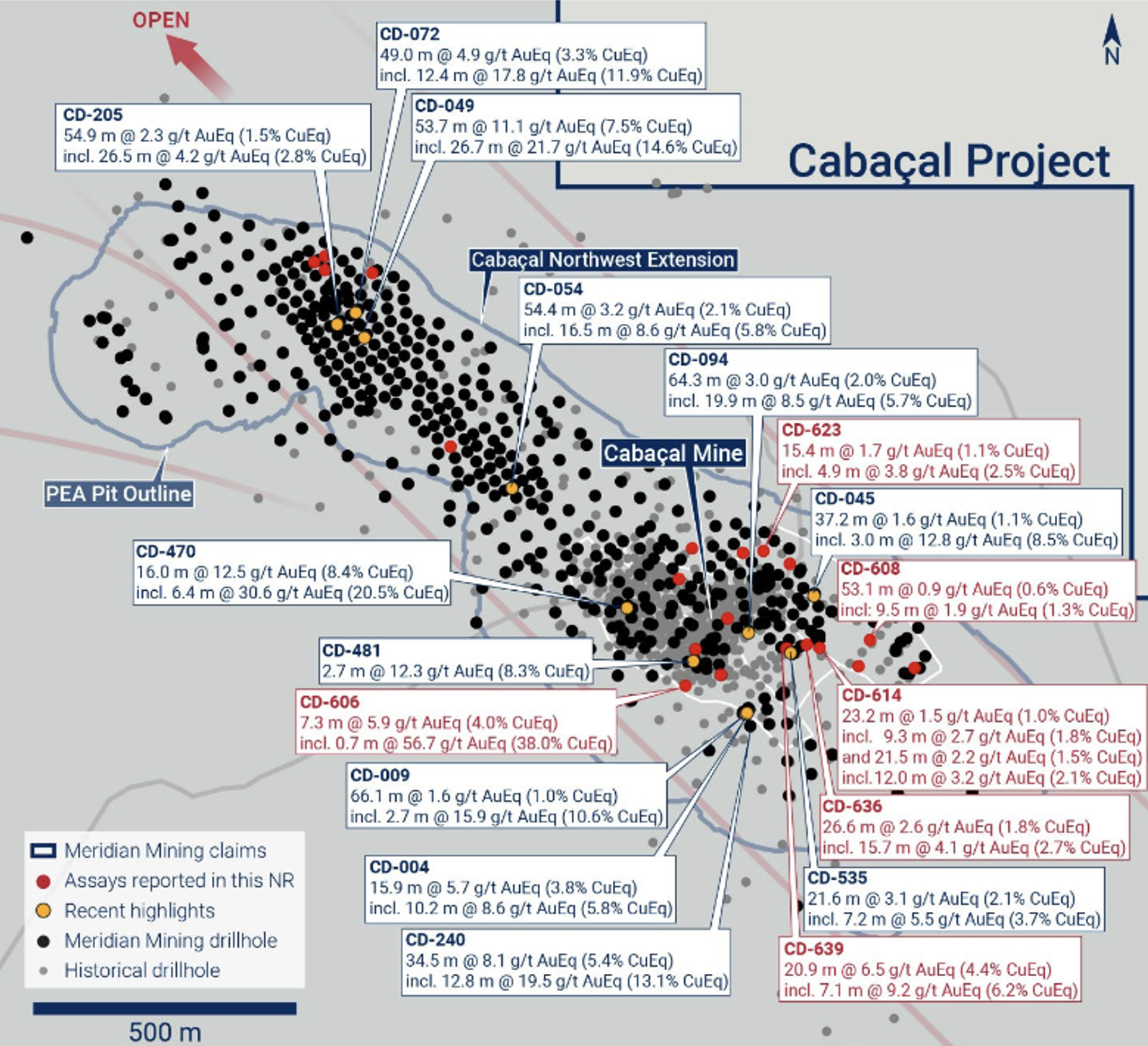

A few thousand kilometers further south, in the Brazilian state of Mato Grosso , is Meridian Mining UK Societas' (WKN: A3EUQY) exceptional asset "Cabaçal" . The cluster of volcanogenic massive sulfide ore deposits ("VMS") has phenomenal mineral resources of an estimated 52.9 million tonnes with terrific grades of 0.6 g/t Au, 0.3% Cu and 1.4 g/t Ag in the "Indicated" category and additional "Inferred" resources of 10.3 million tonnes with grades of 0.7 g/t Au, 0.2% Cu and 1.1 g/t Ag, including a high-grade near-surface zone that supports the construction of a starter mine, and has immense production power .

Source: Meridien Mining

Its powerful potential is more than confirmed by the results of recent drilling that have now been published. Several holes have returned near-surface, super-high-grade results , including the sensational 6.5 g/t AuEq (4.4% CuEq) at a depth of just 95.3 m and over 20.9 m from hole CD-639, including 9.2 g/t AuEq (6.2% CuEq) at a depth of 104 m and over 7.1 m .

Source: Meridian Mining

This illustrious series is continued by drill hole CD-636 with an impressive 2.6 g/t AuEq (1.8% CuEq) over 26.6 m including 4.1 g/t AuEq (2.7% CuEq) over 15.7 m , as well as drill hole CD-606 with a fantastic 5.9 g/t AuEq (4.0% CuEq) over 7.3 m .

High-grade extension of the massive 'VMS' mineralization impressively confirmed!

In addition to the already impressive results , the drilling results also provide impressive confirmation of the high-grade extensions and projections of 'Cabaçal' and its powerful 'VMS' mineralization with robust Au-Cu-Ag contents. This applies both to the 'Central Copper' zone ('CCZ'), from which drill hole CD-639 delivered its sensational 6.5 g/t AuEq (4.4% CuEq) at a depth of just 95.3 m over 20.9 m , and to the 'Eastern Copper' zone ('ECZ'), where drill holes CD-636 and CD-606 produced their splendid results and where targeted drilling is currently filling the potential 'starter mine' to confirm zones with historical geological data.

All in all, Gilbert Clark, CEO of Meridian Mining (WKN: A3EUQY) , can be more than satisfied and is determined to use the now published results as a strong engine for the further dynamic growth of his company:

"With the drilling results now reported, we once again underline in a very impressive way how unique "Cabaçals' potential is to become the next medium-sized copper-gold project in Brazil. They also show that our geological model was a complete success, as it enabled us to identify the high-grade targets that are now being explored. We are all the more pleased to incorporate the current and future results into upcoming studies, as our preliminary feasibility study is already in the final phase. With the recently completed capital increase of CAD 17.2 million, we are also financially well positioned to focus and specifically advance the resource development program for "Cabaçal" and "Santa Helena" as well as other exploration programs this year."

Buy recommendation with a huge price target! Is a MEGA coup on the horizon?

With a clear buy recommendation and an ambitious price target of CAD 2.60, Beacon Securities signals enormous upside potential for this share. With a current price of less than CAD 0.50, this results in a gigantic price potential of around 450%!

![]()

Source: Beacon Securities Limited

Michael Curran emphasized that financing was secured and management could concentrate on exploration and the latest drilling results , which have again delivered sensational hits. It seems as if the course is set for explosive profits. Stay tuned!

Conclusion: Meridian Mining in the fast lane - "Cabaçal" delivers high-grade hits like an assembly line!

What a direct hit! The latest drilling results confirm once again that Meridian Mining UK Societas (WKN: A3EUQY) has an absolutely exceptional project in its hands with "Cabaçal". High copper-gold-silver contents , first-class expansion potential and a near-surface "starter mine" - this project combines everything it needs to position itself as a future top player in the Brazilian raw materials sector!

The latest drilling results in particular are a real sensation : a whopping 6.5 g/t gold equivalent over 20.9 m , plus high copper and silver contents - these are values that every exploration company wants ! And the best part: the potential to the south and deeper remains open !

CEO Gilbert Clark sums it up: "'Cabaçal' is developing into Brazil's next medium-sized copper-gold project ! With the completed capital increase of CAD 17.2 million, Meridian Mining UK Societas (WKN: A3EUQY) is well prepared to really take off and catapult the project into the next growth phase.

This story has everything it takes to become a mega highlight in the copper-gold sector in 2025! Investors beware - Meridian Mining (WKN: A3EUQY) has initiated a real game changer !

Best regards and maximum success with your investments,

Her

Jörg Schulte

Sources: Endeavour Silver, Meridian Mining UK Societas, own research and own calculations. Image sources: Endeavour Silver, Meridian Mining UK Societas, intro image: stock.adobe.com

This promotional article was created on February 26, 2025 by Jörg Schulte, Managing Director of JS Research GmbH. According to Section 84 of the German Securities Trading Act (WPHG), the activities of JS Research GmbH have been reported to BaFin!

Risk information and disclaimer: We expressly point out that we accept no liability for the content of external links. Every investment in securities is subject to risk. Political, economic or other changes can lead to significant price losses. This applies in particular to investments in (foreign) small caps and small and micro cap companies; due to the low market capitalization, investments in such securities are highly speculative and entail an extremely high risk, including the total loss of the invested capital. In addition, the shares presented by JS Research GmbH are partly subject to currency risks. The background information, market assessments and securities analyses published by JS Research GmbH for the German-speaking region were prepared in compliance with Austrian and German capital market regulations and are therefore intended exclusively for capital market participants in the Republic of Austria and the Federal Republic of Germany; other foreign capital market regulations were not taken into account and do not apply in any way. The publications of JS Research GmbH are for information purposes only and expressly do not constitute financial analysis, but are promotional texts of a purely advertising nature for the companies discussed, which pay a fee for this.

No advisory contract is concluded between the reader and the authors or publisher by purchasing JS Research GmbH publications. All information and analyses do not constitute an invitation, offer or recommendation to purchase or sell investment instruments or for other transactions. Every investment in shares, bonds, options or other financial products is subject to - in some cases considerable - risks. The publisher and authors of JS Research GmbH publications are not professional investment advisors!!! Therefore, you should always seek advice from a qualified specialist (e.g. from your bank or a qualified advisor you trust) when making investment decisions. All information and data published by JS Research GmbH come from sources that we consider to be reliable and trustworthy at the time of creation. However, no guarantee can be given with regard to the correctness and completeness of this information and data. The same applies to the evaluations and statements contained in the analyses and market assessments of JS Research GmbH. These were prepared with the necessary care. No responsibility or liability is accepted for the accuracy and completeness of the information contained in this publication. All opinions expressed reflect the current assessment of the authors, which may change at any time without prior notice. No guarantee or liability is expressly assumed that the price or profit developments forecast in the publications by JS Research GmbH will occur.

Disclosure of conflicts of interest: The publishers and responsible authors hereby declare that the following conflicts of interest exist with regard to the company discussed in this publication, Endeavour Silver and Meridian Mining UK Societas, at the time of publication: I. Authors and the publisher as well as consultants and clients close to them do not hold any shares in the aforementioned companies at the time of publication and reserve the right to buy and sell shares at any time and without notice. II. Authors or the publisher or client as well as consultants close to them do not have a direct advisory mandate with Endeavour Silver or Meridian Mining UK Societas at the time of publication, but receive a fee for the reporting via "third parties". III. Authors and the publisher do not know whether other stock market letters, media or research firms are discussing the shares of Endeavour Silver and/or Meridian Mining UK Societas in the same period, which is why symmetrical information and opinion generation can occur during this period. IV. This publication by JS Research GmbH is expressly not a financial analysis, but a publication of a very clear and unambiguous advertising nature on behalf of the company discussed and is therefore to be understood as an advertising/marketing communication.

In accordance with Section 85 of the German Securities Trading Act (WpHG), I would like to point out that Jörg Schulte, JS Research GmbH or employees of the company do not hold any shares in Endeavour Silver and Meridian Mining UK Societas but can enter into their own transactions in the company's shares (e.g. long or short positions) at any time. We expressly point out a conflict of interest. This also applies to options and derivatives based on these securities. Any transactions resulting from this may, under certain circumstances, influence the company's respective share price. The information, recommendations, interviews and company presentations published on the "websites", the newsletter or the research reports are paid for by the respective companies. JS Research GmbH or its employees may be compensated directly or indirectly by the company discussed with an expense allowance for the preparation, electronic distribution and other services. Even if we prepare each article to the best of our knowledge and belief, we advise you to consult other external sources, such as your bank or a trusted advisor, when making your investment decisions. Therefore, liability for financial losses that may result from using the information discussed here for your own investment decisions is categorically excluded. The portfolio shares of individual shares should only be so high, especially in the case of raw material and exploration shares and low-capitalization stocks, that even in the event of a total loss, the overall portfolio can only lose a marginal amount of value. Shares with a low market capitalization (so-called "small caps") and especially exploration stocks, as well as all listed securities in general, are subject to considerable fluctuations. The liquidity in the securities can be correspondingly low. When investing in the raw materials sector (exploration companies, raw materials producers, companies developing raw materials projects), additional risks must be taken into account. The following are some examples of specific risks in the raw materials sector: country risks, currency fluctuations, natural disasters and storms (e.g. floods, storms), changes in the legal situation (e.g. export and import bans, punitive tariffs, bans on raw material extraction or exploration, nationalization of projects), environmental regulations (e.g. higher costs for environmental protection, designation of new environmental protection areas, bans on various mining methods), fluctuations in raw material prices and significant exploration risks.

Disclaimer: All information published in the article is based on careful research. The information does not constitute an offer to sell the shares discussed, nor an invitation to buy or sell securities. This article only reflects the personal opinion of Jörg Schulte and is in no way equivalent to a financial analysis. Before making any investments, professional advice from your bank is essential. The statements are based on sources that the publisher and its employees consider trustworthy. Nevertheless, no liability can be accepted for the accuracy of the content. No guarantee is given for the accuracy of the charts and data on the commodity, foreign exchange and stock markets. The source language (usually English) in which the original text is published is the official, authorized and legally valid version. This translation is provided for better understanding. The German version may be shortened or summarized. No responsibility or liability is assumed for the content, correctness, appropriateness or accuracy of this translation. From the translator's point of view, the message does not constitute a buy or sell recommendation!

JS Research GmbH does not guarantee that an indicated return or stated price target will be achieved. Changes in the relevant assumptions on which this document is based can have a material impact on the targeted returns. The publisher or JS Research GmbH is not obliged to update this document. Income from investments is subject to fluctuations. Investment decisions always require the advice of an investment advisor. This document cannot therefore have an advisory function. Share prices can vary and the company's value can rise/fall. Any reference to past performance is not necessarily an indicator of future developments.

The reader should evaluate any investment in any of the companies mentioned in the light of their own professional advice, circumstances and investment objectives. The author(s) recommends consulting a qualified professional advisor regarding the specific financial risks and the legal, regulatory, credit, tax and settlement consequences. It is entirely possible that the issuers of the securities mentioned here have acted contrary to the case mentioned here without the author(s) of this research note being aware of this development.

No distribution outside the Federal Republic of Germany! This article was prepared in compliance with German capital market regulations and is therefore intended exclusively for capital market participants in the Federal Republic of Germany. Foreign capital market regulations were not taken into account and do not apply in any way. If distributed in the UK, the publication may only be made available to persons who are deemed to be authorised or exempt within the meaning of the Financial Services Act 1986, or persons as defined in Section 9(3) of the Financial Services Act 1986 (Investment Advertisement) or the Exemptions Order 1988, and may not be transmitted directly or indirectly to any other person or group of persons. This document may not be brought into the United States of America or its territories. The distribution of this document in Canada, Japan or other jurisdictions may be restricted by law and persons into whose possession this publication comes should inform themselves about and obtain any restrictions. Failure to observe these restrictions may constitute a violation of US, Canadian or Japanese securities laws or the laws of any other jurisdiction. By accepting this document, you accept all disclaimers and limitations set forth above.

The copyright of the individual articles lies with the publisher. Reprinting and/or commercial distribution as well as inclusion in commercial databases is only permitted with the express permission of the publisher. Use of the publications is only permitted for private purposes. Professional use is subject to a fee and only permitted with the prior written consent of the publisher. Read more here - https://www.js-research.de/disclaimer-agb/ -.

Included values: CA29258Y1034,XD0002747026,XD0002746952,XD0002058432,GB00BR3SVZ18

Disclaimer: The articles offered here are for information purposes only and do not constitute recommendations to buy or sell. They are neither explicitly nor implicitly to be understood as a guarantee of a certain price development of the financial instruments mentioned or as a call to action. The purchase of securities entails risks that can lead to the total loss of the invested capital. The information does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either expressly or implicitly, for the timeliness, accuracy, appropriateness and completeness of the information provided or for financial losses. ABC New Media has no influence on the published content and has no knowledge of the content and subject matter of the articles before publication. The publication of the articles identified by name is carried out independently by authors such as guest commentators, news agencies, companies. As a result, the content of the articles cannot be determined by the investment interests of ABC New Media and/or its employees or bodies. The guest commentators, news agencies, companies are not part of the editorial team of ABC New Media. Their opinions do not necessarily reflect the opinions and views of ABC New Media and its employees. ( Detailed disclaimer )

nachrichten-aktien-europa